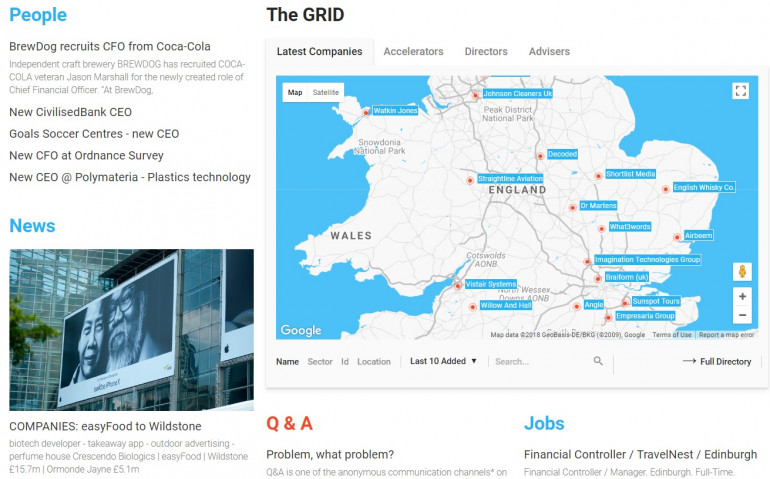

Published by Directorzone Markets Ltd on December 4, 2017, 9:00 am in Knowledge, Market Info

Wednesday January 1st 2020

French Tech Competition | Growth Company M&A; | Angel Q&A; | Networking + Boards | Deloitte Fast 50 | New Entrepreneurs Foundation | SME pitch to Corporates | Start -> Scale-Up | Private Equity eating out less | SMEs: Top Growth Sectors | Trademark Disputes | Show Up

Digest of news and trends in the GRID marketplace in November 2017:

FRENCH TECH COMPETITION

France looks to steal UK tech’s European crown | Aliya Ram, FT. November 30, 2017

Research by ATOMICO, the London-based venture capital company that compiled data on 3,500 founders and investors, found that UK start-ups have raised $5.4bn this year, more than double the funding that has gone into French tech companies. However, the total number of deals was lower at 728 compared with 753 in France, in a sign that investors see increasing opportunities in early-stage companies on the continent.

By contrast, the report found that UK-based entrepreneurs are losing confidence in the future of the European tech sector as stalled Brexit negotiations create uncertainty for venture capital groups and EU migrants.

France, home to start-ups valued at more than $1bn including BLABLACAR, the car-sharing group; CRITEO, the digital advertising company; and TALEND, the data analysis business, is the UK’s biggest emerging competitor.

Romain Lavault, general partner at PARTECH VENTURES, a French investment company that shelved plans to open a London office after Brexit, said the shift in attitude had been marked since Mr Macron’s election.

At the same time, hundreds of developers have rejected jobs in the UK since the Brexit vote because of uncertainty over new visa rules. Germany now has 3 per cent more skilled computer developers than the UK, compared with 5 per cent fewer last year.

GROWTH COMPANY M&A;

Entrepreneurs sell up over Brexit and Corbyn fears | Andy Bounds, FT. November 27, 2017

The BARCLAYS ENTREPRENEURS INDEX found that 505 businesses were sold by entrepreneurs last year, which represented a 28 per cent increase compared to 2015, and the highest level since the bank started tracking such activity in 2010. Barclays counts the number of mergers and acquisitions involving businesses less than five years old.

The trend of entrepreneurs selling businesses may be the result of an uncertain political and economic environment in 2016, which made it difficult for companies to plan ahead and grow, said the bank.

Caroline Belcher, a partner at CAVENDISH CORPORATE FINANCE, an M&A; advisory firm, said …there was a sales pause after the referendum vote but her firm had advised on 19 deals since then.

THE SUPPER CLUB, a networking group for entrepreneurs in London, said its members had raised a record £1.2bn from exiting businesses this year. With growing inquiries from members worried about Brexit, it has published a book of advice on how to sell. James Monico, a member of The Supper Club, sold a majority stake in his technology business CLOUDREACH to private equity firm Blackstone in February.

Leaving so soon? UK founders lack big tech exit ambitions | Lynsey Barber, City A.M. November 15

VENTUREFOUNDERS and BEAUHURST surveyed 100 founders of fast scaling startups of various sizes and ages and across sectors, but including fintech, e-commerce and analytics. They found that

- most entrepreneurs are eyeing an exit within two to five years and are prepared to sell for less than £50m. Just one per cent said they expect to sell for more than £1bn. The UK has produced just four per cent of the world’s nearly 200 so-called unicorns, research from HM Treasury shows

- Over two-thirds said they were shaping their business to prepare for an exit, but the same proportion also said they thought there was a risk of exiting too early.

- UK startups were found to have had fewer funding rounds before exiting - either via IPO or a sale - compared to peers in the US, according to data from the British Business Bank.

- A younger ecosystem with fewer serial entrepreneurs were also mentioned by several of the well-known founders and VCs who were spoken to by the researchers.

- The availability of funding being smaller in the UK than the US was cited by Jon Reynolds, co-founder and chief executive of SWIFTKEY, which sold to Microsoft for $250m last year, while one anonymous founder noted VC’s short-term outlook.

“People in the UK tend to be a little more reserved. They tend to undersell the business opportunity,” said venture capitalist Simon Calver of BGF VENTURES. “But I think they also tend to focus a little more on the structure and direction of a business. In the US, they focus more on product and vision and how things will change. They tend to be more global in how they think about it.”

….co-founder of VENTUREFOUNDERS James Codling said: “I think the business community is failing the UK’s entrepreneurs. Despite venture capital in London being ten times higher now than in 2010, the VC world is not willing enough to take on the risk, a lack of competition is driving down standards, and we have failed to create an ecosystem of founders who have experienced success themselves who then go on to nurture the next generation,”

“The PATIENT CAPITAL REVIEW will hopefully address some of the challenges, but government propping up this industry is not the long-term answer; proving we can build tech companies with value and encouraging institutional investment in venture is the only sustainable solution.”

British firms set for M&A; buying spree despite uncertain outlook | Jasper Jolly, City A.M. November 6, 2017

Some 60 per cent of British companies surveyed by accountants EY are planning acquisitions in the course of 2018, a nine percentage point rise since April, a report to be published today will reveal. Strong cross-border deal-making was seen as the main driver of merger and acquisition (M&A;) activity by 29 per cent of the 3,000 top executives polled by EY worldwide. The UK is set to retain its position as the third most popular destination for inbound M&A; deals worldwide.

M&A; activity held up in the aftermath of the EU referendum, aided by the fall in the value of sterling, which has made British assets more attractive for overseas buyers.

EY’s findings are corroborated by a confidence measure from the Institute for Chartered Accountants (ICAEW), which found that firms expect a profit pick-up next year in a separate survey of more than 1,000 UK businesses. Firms expect profits to grow by 4.7 per cent next year as sales rise and input price inflation eases back.

The survey also found signs that export sales are picking up, driven by strength in production. Meanwhile, businesses expect domestic sales will expand by four per cent in the year ahead, a pace not seen for two years.

However, economic growth is forecast to slow in the fourth quarter, with the ICAEW’s confidence data suggesting GDP growth of 0.2 per cent. An index collating major business surveys from the Bank of England, the Confederation of British Industry (CBI) and IHS Markit’s purchasing managers’ index (PMI) to be published today will show output growth falling to a 21-month low.

The analysis comes as the CBI warns that uncertainty is holding back investment, with more than half of UK businesses saying the economic outlook is a concern, according to a poll carried out by the lobby group. Meanwhile, 39 per cent of firms named the Brexit process as a key concern.

ANGEL Q&A;

Every week we talk to a business angel, one of the early-stage investors who collectively inject £1.5bn a year into British start-ups | Peter Evans, The Sunday Times:

REECE CHOWDHRY - November 19, 2017

Reece Chowdhry, 28 …ex-EY consultancy…invests through RLC Ventures, which he founded in 2015 …backs property and technology businesses, such as LANDLORDINVEST, a peer-to-peer lending platform for buy-to-let property, and BETTINGMETRICS, an interactive dashboard for gamblers. He has made 10 investments of between £20,000 and £250,000.

- I have developed a model that evaluates up to 50 personality traits in a founder to see how they would react in certain scenarios. We put the results into an Excel model that comes out with a figure. It helps avoid bias.

- If it’s an industry I don’t know much about, I seek advice from people who do. It’s often executives at companies in the same industry. Sometimes they end up investing too.

- Wish I saw fewer . . .People who leave their well-paid jobs and pitch to us, saying they want to earn what they did in the City. That’s not how it works in the start-up world.

- Next disrupted industry. Insurance. We’re still in the dark ages. People are fed up with filling out forms and going to 10 separate brokers. A shock is coming in the next two or three years.

PETER COWLEY | November 5, 2017

Peter Cowley, 62, founded a series of technology and construction companies before switching to angel investing a decade ago.

He is chairman of CAMBRIDGE ANGELS and has invested in more than 60 start-ups. They include the internet of things developer NEUL, which was sold to Chinese giant Huawei three years ago for $25m, and the equity investment platform SYNDICATEROOM.

- What I look for: A stellar team of two or three founders. They need the ability to listen and be truthful, honest and open. The market and tech don’t matter so much. I recently rejected a project without looking at the business plan. I just couldn’t back the team.

- We need more people with experience in the [angel investing] industry, rather than more cash. It’s skills we need, with people willing to put more time into it.

- Lessons learnt: Build up a decent-sized portfolio and don’t invest in teams where there’s an emotional relationship. Boyfriends and girlfriends or even siblings often don’t work out. But if I’m going to be anywhere near the board, there has to be some chemistry between the members.

- Early customers can be misleading. If you’ve got a £10,000 order from Amazon, that doesn’t mean anything. It doesn’t give the business validation.

- Wish I saw more . . .Women founders. Only 7% of the founders I’ve backed have been women. I think it’s because of poor Stem [science, technology, engineering and maths] education for women. It is changing and we will see more female founders.

- Wish I saw less . . . Artificial intelligence. So many people claim they do AI and it’s rubbish. Machine learning I accept — things such as choosing your next movie on Netflix. I do not accept that these companies are AI.

- Next disrupted industry Personalised medicine — using software to perfect the dose and chemical structure of medicines before they’re given. Also, related to that, using robotics in medicines.

NETWORKING + BOARDS

Teach yourself to . . . learn from your peers | Liam Kelly, The Sunday Times. November 19 2017

Launching a new product or service can be disorienting, especially if you are doing it for the first time. “NETWORKS are powerful tools, and when you become part of the right ones, it can amplify your skills and abilities massively,” said Parveen Dhanda at Tech City UK, the government-backed body that helps technology companies.

As their businesses grow, entrepreneurs have to deal with hiring people, opening offices and becoming responsible for the livelihoods of others — a far cry from the ideas that got their start-ups off the ground in the first place. It is in these situations that peer support is helpful. “This is your HR department, your legal department, your counselling session and your workmates all in one,” Dhanda explained. “The networks you make when you are starting to build a business can be some of the most productive and useful you will ever have.”

By joining incubator programmes and talking to other entrepreneurs, you can compare notes and learn from one another. Speaking confidentially with peers about strategic decisions can even lead to unexpected collaborations or partnerships. “After all, everyone wants to expand their business,” Dhanda said.

These relationships aren’t just important for start-ups, but throughout the life of a business. More established names are increasingly willing to advise companies with new concepts — and sometimes collaborate.

Teach yourself to . . . choose a board | Liam Kelly, The Sunday Times. November 5 2017

Deciding who to put on a BOARD is one of the most critical choices for start-ups. Young businesses rely on board members to help them cope with growing pains. But an effective board must be more than “an oversight body for the chief executive”, said Colin Hanna of the venture capital firm BALDERTON CAPITAL.

“The board should spend the majority of its time discussing the most important strategic questions, rather than reviewing performance or chastising missed budgets,” said Hanna. “When a company is struggling, the board looks to problem-solve, rather than assign blame.”

Diversity is encouraged, but start-ups shouldn’t try to force a balance of views on the board, said Hanna. “….make sure board members are truly independent and will speak their mind.”

Once a business is growing, Balderton advises bringing in at least one non-executive director who knows the industry, “because the shareholder lens is not always the company lens”. At this stage, said Hanna, it may also be worth appointing an independent chairman to ensure “the board stays on course and defines the optimal agenda”.

DELOITTE FAST 50

Lynsey Barber, City A.M. November 17, 2017

Deloitte's annual Fast 50 list of the fastest growing technology firms, now in its 20th year

“… DELIVEROO is now the fastest-growing technology company in the history of the competition," said lead partner for the Fast 50 programme David Cobb. ….recording an unprecedented growth rate of 107,117 per cent over the past four years.

In second place was another delivery startup, but swapping food for flowers. BLOOM & WILD notched up impressive growth of 13,818 per cent. And MOVEGB, which offers users access to thousands of fitness classes at different places via a single membership, made it into the top three, growing at a rate of 6,053 per cent.

Other top performers were SMARKETS, the fastest growing fintech at a rate of 5,390 per cent, and fourth overall along with BRAINLABS, which grew 1,913 per cent. It was the highest ranked firm in the media and entertainment sector and tenth overall.

1 DELIVEROO 107117% London Internet

2 BLOOM & WILD 13818% London Internet

3 MOVEGB 6053% South West Internet

4 SMARKETS 5390% London Fintech

5 STRATAJET 3634% London Internet

6 PADDLE 3239% London Software

7 RECEIPT BANK 2947% London Fintech

8 GOCARDLESS 2097% London Fintech

9 COULL 1915% South West Media & Entertainment

10 BRAINLABS 1913% London Media & Entertainment

11 OUTPLAY ENTERTAINMENT 1904% Scotland Media & Entertainment

12 LOOPME 1825% London Software

13 VIRTUS DATA CENTRES 1729% London Software

14 OPTAL 1714% London Fintech

15 KANTOX 1688% London Fintech

16 MOBSTUFF 1635% London Media & Entertainment

17 DUCO 1590% London Fintech

18 IN TOUCH NETWORKS 1572% North West Internet

19 WDX 1563% London Fintech

20 VOLTA DATA CENTRES 1562% London Software

21 PM CONNECT 1319% Midlands Media & Entertainment

22 CYANCONNODE 1221% Cambridgeshire and East Telecommunications

23 IESO DIGITAL HEALTH 1175% Cambridgeshire and East Healthcare & Life Sciences

24 YIELDIFY 1144% London Media & Entertainment

25 BIGCHANGE 1095% North East Software

26 POQ 1015% London Software

27 EXSEL GROUP 959% Scotland Software

28 REALEYES 932% London Software

29 FUNDING CIRCLE 853% London Fintech

30 REDDICO 851% South East Internet

31 FONIX 785% London Fintech

32 STARLEAF 782% London Software

33 KYMAB 763% South East Healthcare & Life Sciences

34 VICTOR 716% London Internet

35 BLIS MEDIA 702% London Media & Entertainment

36 FEATURESPACE 677% Cambridgeshire and East Software

37 MIGHTY SOCIAL 651% London Media & Entertainment

38 FARFETCH 649% London Internet

39 WORLDREMIT 642% London Fintech

40 NERVECENTRE SOFTWARE 636% South East Software

41 BLACK SWAN DATA 597% London Software

42 BLUEGLASS 561% London Media & Entertainment

43 BOOKINGBUG 554% London Software

44 PEPPERMINT TECHNOLOGY 552% Midlands Software

45 EBURY PARTNERS 548% London Fintech

46 SIPHON 539% South West Telecommunications

47 CLOUD TECHNOLOGY SOLUTIONS 510% North West Software

48 ACCESSPAY 497% North West Fintech

49 ARCUS GLOBAL 491% Cambridgeshire and East Software

50 SEEDRS LTD 481% London Fintech

NEW ENTREPRENEURS FOUNDATION

UK's entrepreneur bodies merge to create a talent development powerhouse, as Aldermore floats the idea of an Entrepreneur ISA | Lucy White, City A.M. November 15, 2017

The UK's NEW ENTREPRENEURS FOUNDATION and the Centre of Entrepreneurs … will merge, to create a not-for-profit “entrepreneurial powerhouse”. ….to train the next generation of social and business leaders, deliver research to identify gaps in current support, and provide input into UK government policy around entrepreneurship.

The newly combined organisation, which will retain the New Entrepreneurs Foundation name, will scout the UK's most entrepreneurially minded young people and help them establish their businesses through mentorship programmes. Almost 200 people have gone through the foundation's programme since its launch in 2011, and have since launched 92 businesses, raised a total of £27m in funding and created more than 1,000 jobs.

LETTERONE, the investment business headed by Russia's Alfa-Group founder Mikhail Fridman, supported the merger with a £1m donation over three years.

The Centre for Entrepreneurs will maintain its research, the FOUNDERS CLUB and best practice networks including the PRISON ENTREPRENEURSHIP NETWORK and the INCUBATOR AND ACCELERATOR NETWORK.

SME PITCH TO CORPORATES

How to drive growth by joining the dots | City A.M | Dave Challis, VP of Innovation at RB. November 13, 2017

Look out for opportunities to connect with big corporates. New research from ENTERPRISE NATION, commissioned by RB, found that 77 per cent (of British entrepreneurs and SMEs) want to drive growth by repurposing their existing products, with 78 per cent planning to scale and grow domestically and internationally over the next two years.

…. while 66 per cent would consider partnering with a multinational organisation to scale their business or take it in a new direction, they haven’t yet. The vast majority do not even know where to start when it comes to seeking these prized potential partners.

… Rather than blanket-pitching numerous companies, they should identify only a handful to target and investigate what both would bring to the table in the partnership.

Next, look out for opportunities to connect with big corporates, whether that’s at conferences and networking events, through online portals, or on LinkedIn. Critically, have an elevator pitch ready to grab their attention.

Once a connection has been made, focus on making an impact straight away. The best pitches are those where business owners tell a story of why their product matters, and really engage prospective partners.

In as little as 12 months, an agile partnership can deliver a new product to market.

START -> SCALE-UP

Start-ups beg for help with growing pains | Peter Evans, The Sunday Times. November 12, 2017

According to figures from the OECD, Britain is third in the world for starting new businesses, but falls to No 13 for scale-ups — defined as companies with at least 10 workers that improve annual turnover or staff headcount by 20% for three consecutive years. These businesses are like gold dust for governments, creating wealth and jobs. Between 2013 and 2015, Britain’s 30,000-plus scale-ups generated £900bn in turnover, says the OFFICE FOR NATIONAL STATISTICS.

A report to be released this week by the SCALEUP INSTITUTE, a not-for-profit organisation set up two years ago to help British companies, will show that 343 of the fastest-growing businesses in the country average £240,000 in turnover per employee.

The report will add that almost half the owners of scale-ups feel they do not have enough support, with their concerns ranging from attracting talent to finding investment and gaining access to international markets.

The challenges are familiar to Goldsmith.

The ScaleUp Institute … Among its recommendations is creating an army of local account managers to work directly with scale-ups in an attempt to boost growth outside London. Irene Graham, the institute’s chief executive.

Soon after becoming prime minister in 2010, David Cameron announced a series of initiatives to boost the number of start-ups. Among the most successful programmes has been TECH CITY UK, which provides training and support for promising new technology companies. Alongside government-sponsored programmes, a multitude of start-up incubators have sprung up, offering workspace and networking and giving support to founders that otherwise would not be available. But the consequence, according to some, has been an obsession with start-ups — with little attention paid to what happens when a business becomes established.

“The accelerator and incubator industry does not prepare start-ups for the next step,” Said Jim Duffy, Co-Founder of Moonshot Academy, a programme designed to help owners grow their companies. “

One of the main issues for founders is having to find new investment when they could be running their business. “I had to devote 50% of my time to funding meetings,” said Martin Ijaha, who co-founded the fintech company NEYBER three years ago. “To some extent, it delayed our growth.” It paid off in the end for Ijaha. Earlier this year Neyber, which provides loans repaid out of people’s salaries, secured £100m in funding from Goldman Sachs.

PRIVATE EQUITY EATING OUT LESS

Private equity loses its appetite for London’s restaurants | Conor Sullivan and Javier Espinoza, FT. November 10, 2017

The pace of restaurant openings in London has slowed in the past year, as a wave of private equity funding appears to have run out of steam. Net openings tracked by the Harden’s London Restaurant Guide fell by 12 per cent, to 109, in the year to September, after a small drop in the number of openings and a larger rise in the number of closures. Eighty-four restaurants closed in the 12-month period — the third-highest number of closures on record in a single year, according to Harden’s.

Peter Harden, who has compiled the guide for the past 26 years …. pointed to rising business rates, rents and higher costs for food imports, as well as Brexit-related staff shortages to explain the closures, which he said included some unlikely names. Companies have also had to grapple with higher employment costs following the introduction of the national living wage and pension auto-enrolment.

One private equity financier and director of several restaurant chains said: “A lot of people in private equity firms have made a lot of money out of it, and the music has begun to stop,” …. before predicting a “shake-out” similar to what has happened in the gyms market, where “the guys at the top and bottom keep going but the guys in the middle get mullered”.

Many private equity-backed restaurants have struggled to differentiate themselves in an increasingly crowded market:

- PREZZO, the TPG-owned Italian restaurant chain, appointed property agents to explore the sale of 27 of its restaurant leases in July — a move that was widely seen as a tacit admission of a challenging trading environment. The company has said it is looking to open between 6 and 10 branches in the coming year. The chain was taken private two years ago, in a deal that valued the company at £304m.

- COTE BRASSERIE, which is owned by BC PARTNERS, has seen its profits slip. The company posted profits before tax of £10m this year, compared with £13.9m last year, according to the company’s accounts. This year, the business has improved, a person close to the company said. BC Partners bought the chain two years ago for £250m.

SMEs: TOP GROWTH SECTORS

The number of smaller businesses in the UK has shot up: Here are the top-growing sectors | Lucy White, City A.M. November 9, 2017

The number of small and medium-sized enterprises (SMEs) in the UK has grown by almost a quarter over the past five years, new research from HAMPSHIRE TRUST BANK and the CENTRE FOR ECONOMICS AND BUSINESS RESEARCH (CEBR) has revealed. The sectors with the fastest-growing number of SMEs 2011 – 16:

· Office admin and business support - 76 per cent

· Human health services - 50 per cent

· Motion picture, video, TV, sound recording and music publishing - 50 per cent

· Other professional, scientific and technical - 48 per cent

· Land transport and pipeline transport - 46 per cent

· Head office and management consultancy- 45 per cent

· Computer programming - 44 per cent

· Architectural, engineering & technical testing - 44 per cent

· Transportation and storage - 41 per cent

· Activities auxiliary to financial services and insurance, including online trading platforms - 40 per cent

However, the research found that real estate SMEs feel less confident about the future of their industry than last year. Economic uncertainty and the level of taxation were named as key barriers to growth…

TRADEMARK DISPUTES

Beware the wrath of big brands and their lawyers | Peter Evans, The Sunday Times. November 5, 2017.

Trademark law is increasingly being used as a tool to attempt to crush small businesses. A string of recent cases involving multinationals ….show the willingness of large corporations to threaten much smaller ones with legal action.

NUSH FOODS makes dairy-free yoghurts that are sold in Waitrose and Sainsbury’s. Founded by Bethany Eaton, 39, with her husband, Paul, last year. Both served in the Metropolitan Police before pouring £150,000 of savings into the start-up. ….are fighting back in a trademark dispute ….the latest in a long line of trademark disputes that appear to pit David against Goliath:

- When a curtly worded letter arrived accusing Nush Foods of trademark infringement came from the lawyers BAKER MCKENZIE representing NOSH ….. Nush had registered trademarks in Britain and the EU. That didn’t wash with Baker McKenzie, which demanded that Nush change its name within six months — or face the consequences.

- Berkshire drinks business THIRSTY BEASTS, set up by an Iraq war veteran, was last month threatened by lawyers representing the US giant Monster Beverage, which objected to the use of the word “beast”.

- And earlier this year, the Scottish craft beer company BREWDOG threatened legal action against a Leeds pub with the word “punk” in its name. BrewDog, whose best-selling brand is Punk IPA, eventually backed down.

UK intellectual property law “makes it very hard for big business to act like bullies”, said Kate O’Rourke, president of the UK CHARTERED INSTITUTE OF TRADE MARK ATTORNEYS. Big companies are by no means in the wrong in all cases and problems can easily be avoided. Many small business owners fail to trademark their brands, or do not carry out sufficient research before choosing a name. O’Rourke recommends seeking specialist help, and it does not have to cost anything: some trademark attorneys offer an initial 30 minutes of free advice.

FT READER COMMENTS:

Amin Smith. Mrs Eaton should use the reference number on the letter she received to identify the solicitor who has 'carriage' of the file; if she telephones Baker Mackenzie and quotes the number the receptionist will tell her which solicitor it applies to. She should then instruct her lawyers to write directly to that solicitor, copied to the senior partner and the partner in charge of the relevant department, and telling him/her that they have 24 hours to withdraw the letter and apologise unreservedly or not only will they be reported to Baker Mackenzie's senior partner for misconduct as a Baker Mackenzie employee and Mrs Eaton will seek to have them sacked, but also to the Solicitors' Regulation Authority for gross professional misconduct and Mrs Eaton will seek to have him/her struck off for life. I.e. apologise and withdraw or lose everything. Mrs Eaton's lawyers should also point out that it is a criminal offence under English law to make unjustified threats of legal action and if the apology and withdrawal are not forthcoming as demanded the solicitor responsible will also be reported to the police, and may face arrest and prosecution.

James Lawson XIX. As they teach you in law school. If your client has either a dog's chance or no chance of succeeding. Then his or her chances of a favourable result may be considerably improved depending on your skill at crafting properly worded letters in terrorem. You should stress that a failure to comply with your client's demands will inevitably result in needlessly expensive litigation damages and costs which, together with adverse publicity, damage their client base and have a much wider and long term debilitating effect on their ability to raise cash from commercial lenders, the cumulative effect of which would make it difficult, if not impossible to continue in any form of business venture.

The smaller and more financially vulnerable the business, the more likely it is that they will fall victim to the Milgram effect. That is to say, they will attach undue weight to the authority underpinning the title 'solicitor' on the letterhead than they will to the paucity of authority underpinning the validity of claim against them, which in some cases may be quite ludicrous. Your principal weapon is the natural inclination of people to be swayed by the status of the individual advancing the contention rather than the validity of the authority that underpins it.

SHOW UP

Luke Johnson: Don’t be a shrinking violet: to win, you need to get out more | The Sunday Times, November 5 2017.

Luke Johnson is chairman of Risk Capital Partners and the Institute of Cancer Research.

When I analyse how and why I did the deals that really mattered, it is hard to draw hard and fast rules. However, I do have some habits and techniques — developed over the past few decades — that I think have helped.

Most important, you should position yourself where events flow fastest. This principle applies to anyone with ambition who wants to make an impact, in any walk of life. Go where the action is greatest. Make yourself open to new connections. And meet dynamic people as often as you can; face-to-face encounters really matter when forging new partnerships.

Digital networking methods, such as email and LinkedIn, have their place, but actually being in the room can make all the difference. So make the effort — show up; you never know what might happen.

I have always included my email address at the bottom of my column because it is important to be accessible. If you stand aloof and make it hard for people to contact you, fewer situations will come your way.

I also get out and about giving speeches. …they can act as a pitch to would-be partners who want to understand your philosophy and why you might be a person with whom they should do business.

I have always argued that identifying great business openings is as much about intuition and common sense as it is about spreadsheets. And, of course, it is about optimism: approach the world with a positive viewpoint and you are likely to be luckier — and better placed to take advantage of the moment.