Published by Directorzone Markets Ltd on November 21, 2016, 9:00 am in News, Other

Directorzone

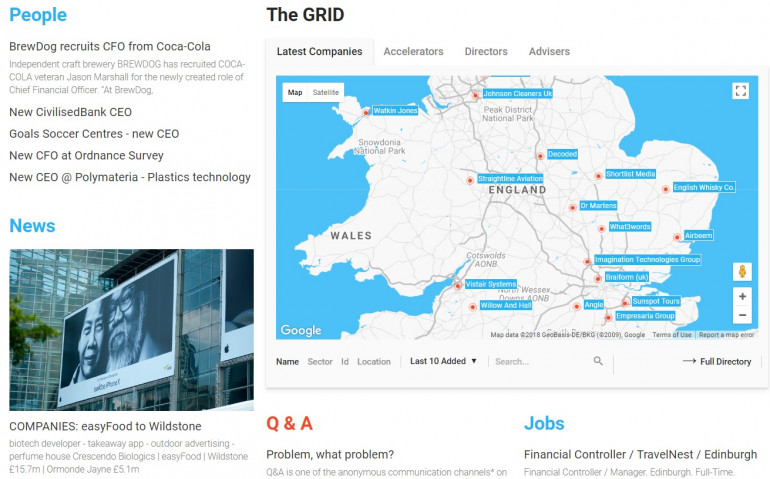

News about 7 UK growth companies and/or accelerators + turnover in the GRID marketplace, 13th – 19th November 2016:

Whistles £62.2m | Wheyhey | PJ Care £15.8m | Nutmeg | Facewatch | Matchesfashion.com £126.9m | Bluebella £1.7m

WHISTLES: Big losses | Oliver Shah, The Sunday Times. November 13

DZ profile:

Business: upmarket womenswear retailer which owns 46 standalone stores and 74 concessions.

Financials: reported a 1% rise in its turnover to £62.2m, for the 12 months to January 30. Its pre-tax losses ballooned from £2.4m to £15.5m.

Investment: acquired by Foschini - the South African owner of rival Phase Eight - in March. Former chief Jane Shepherdson, 55, acquired a 20% stake in Whistles from Baugur, the now-defunct Icelandic conglomerate, when she took the reins in 2008. Shepherdson retained this stake when she left Whistles in September.

WHEYHEY: Whey to go global | HSBC advertisement in The Sunday Times.

DZ profile:

Business: Ice cream maker. Created Wheyhey Ice Cream, a tub of which the founders claim has the same nutritional value as a chicken breast. “Our first retailer was As Nature Intended, a small chain with six stores in the capital. We convinced them to stock Wheyhey and it became one of their fastest selling products. Soon after that Holland & Barrett got in touch and we went from there to Ocado and recently Tesco.”

Launched: 2013

Founders: Damien Kennedy and Greg Duggan, who studied physiology and biomechanics together at Brunel University

News:

1. Within a year Wheyhey had caught the eye of Richard Branson, become a Virgin Media Pioneer business and bagged supermodel David Gandy as the face of the brand. Gandy is now an investor.

2. Wheyhey also started exporting within 12 months of its 2013 launch and now exports all over Europe and as far as Kuwait. It will be available in Saudi Arabia from January and Australia by the end of the year. “We do lots of research before entering a new market,” says Kennedy. “Luckily UKTI has case studies on most export regions and we use sources like Mintel, which has marketing data and can provide grocery sales for a certain country and details of the types of products people are buying.”

PJ CARE: Health service red tape inspired me to open a care home | Laura Onita, The Sunday Times

DZ profile:

Business: business that provides care for people with early onset dementia and Huntington’s disease, or those recovering from neurological traumas such as brain injuries. PJ Care’s beds are filled solely by patients referred by NHS hospitals, such as Addenbrooke’s in Cambridge and Stoke Mandeville in Aylesbury. It costs about £2,000 a week for a bed and the nurses, consultants and therapists who treat the patient — her fees are more than double the care-sector average.

Launched: 1999

Location: seven centres — three in Milton Keynes and four in Peterborough

Founder: Former nurse, Jan Flawn, 69.

Staff: 500

Financials: posted pre-tax profits of £1.6m on sales of £15.8m this year. It expects revenues of £20m for 2017.

Investment: Flawn has had offers to sell, but always refused: “Someone recently wanted to buy it for £45m”.

News:

1. After four years of working as an adviser to the Department of Health, worried about the lack of specialist care for younger patients suffering from dementia, she resigned to build her own nursing home, PJ Care in Milton Keynes, in 1999 with a £750,000 bank loan. It took a year to persuade a bank to back her first centre, Bluebirds, in 2001. Within six months she had filled all 22 beds and had a waiting list. She reinvested profits to open two more facilities in 2005 and 2012.

2. She plans to open five more centres in the next five years and expand in Milton Keynes, where PJ Care is based.

3. Hiring good nurses is difficult; 25% of PJ Care’s nurses are from abroad.

4. In 2014 she was made a CBE, and was a finalist in this year’s Forward Ladies awards.

NUTMEG

DZ profile: Nutmeg Saving And Investment Limited

Business: small, technology-driven UK fund management group which offers low-cost automated online advice. Nutmeg founder Nick Hungerford developed the idea when he was at Stanford Business School in California. He wanted to build a fund management firm that would allow ordinary retail investors with as little as £1000 access to the very best investment ideas from the very best fund managers, with portfolios specifically tailored to meet their needs. He proposed to harness technology to make this happen at very reasonable cost. His was thus a pioneer in the UK of what became known as robo-advisers — a new kind of fund manager where technology is supposed to do the work once performed by expensive humans. ..fierce competition from a host of high street banks launching competing robo-advice platforms. Barclays, Royal Bank of Scotland, Lloyds, Santander and Standard Life have all said they are developing online wealth management offerings.

Launched: 2011

Location: London

Founder: Nick Hungerford,

Staff: Martin Stead, chief executive. Johnny Chen, senior adviser to Convoy and former Greater China CEO of Zurich Insurance Group, will take a seat on the Nutmeg board. Chairman, Craig Anderson. Board includes Massimo Tosato, executive vice-chairman Schroders

Financials: posted pre-tax losses of £9m this year

Investment: this week has attracted £24m from CONVOY, Hong Kong’s largest listed financial advisory firm, as well as £6m from its existing backers. UK asset manager SCHRODERS, which invested £12m in Nutmeg in a previous funding round, and private equity houses BALDERTON CAPITAL - which previously backed LoveFilm and Zopa - and PENTECH were among the current backers that increased their stake in the start-up. Other investors include Michael Spencer of Icap, Charles Dunstone of Carphone Warehouse and Tim Draper, who was an investor in video messaging service Skype.

News:

A bad choice to spice up fintech | Anthony Hilton, Evening Standard. November 16.

1. Nutmeg is nothing special in technical terms, pretty unsuccessful in attracting clients and mildly embarrassing for backers who have already invested more than £50 million in it. ... has failed to find enough clients — and those it has attracted have, for the most part, not put in enough money.

2. Hungerford ...was removed as chief executive earlier this year ...got the firm to a position where potentially it could deliver on its side of the bargain, garnering a lot of publicity on the way, but the firm also developed a habit of making losses that were substantially bigger than its revenues.

3. Some hard-bitten investment professionals have serious doubts about whether the business model for robo-advisers makes sense. i.e. Alan Miller, once a star at New Star who now runs portfolios of exchange-traded funds with wife Gina (the Article 50 litigant) at SCM PRIVATE.

Lossmaking online wealth manager Nutmeg raises £30m | Aime Williams and Attracta Mooney, FT. November 15.

4. … raised £30m … in a deal that underscores the belief that low-cost “robo-advisers” will reshape financial advice even though firms have had limited success so far. Nutmeg said it was considering using the funds to expand into Asia. The funding round is the largest in a UK fintech company since the country voted to leave the EU. It doubles the total investment in Nutmeg.

5. Asset managers, banks and other investors have rushed to back or launch robo-advisers in recent years, believing a new generation of consumers will increasingly go online to make investments. …

6. Citigroup, the US bank, estimates that the assets managed by robo-advisers could reach $5tn during the next decade, fuelled by younger investors who are comfortable investing online. However, many robo-advisers have struggled to attract investors’ money from traditional wealth managers — and few are profitable. According to research by SCM Direct, a UK wealth manager, most UK robo-advisers “will go bust before acquiring the sizeable assets under management to ensure their sustainability”.

UPDATE:

Digital wealth manager Nutmeg targets 'seven figure sum' in crowdfunding round | Jessica Clark City A.M. 27 March 2019

7. ...will launch a crowdfunding round this year, targeting a seven figure sum. ….counts GOLDMAN SACHS, TAIPEI FUBON BANK, CONVOY and BALDERTON CAPITAL among existing investors, is opening up company ownership to its customers in partnership with equity funding platform CROWDCUBE. The proceeds will fund international expansion and development of new features for customers

8. ...the UK’s largest digital wealth manager.

FACEWATCH: has an eye on $1bn club with arresting way to fight crime | Russell Lynch, Evening Standard. November 14, 2016

DZ profile: Facewatch Limited

Business: facial recognition system allows edited video footage to be emailed straight to the police, and lets businesses and the public share intelligence. It uses off-the-shelf facial recognition software to match criminals against police watch lists, and against watch lists compiled by its customers.The idea came from the frustration the founder felt when trying to report petty crime, and the challenge of the police accessing the CCTV footage and wading through it. Next stage of evolution: combining Facewatch’s data with a new age of advanced face-recognition cameras. Planning a UK launch in the next couple of months after a successful pilot in Brazil that was three years in the making.

Founder: chartered accountant, Simon Gordon, 60, didn’t have his big idea until well into his fifties. Ex- finance director of Skandia UK.

Financials: He’s been burning through cash but reckons the company will be producing eight-figure revenues within three years.

Investment: Gordon still owns more than half the company. Raised £484,620 from148 investors on CROWDCUBE by 2016.

News:

1. Advisers include: former MI5 head Jonathan Evans + James Macpherson, one of the most senior UK figures at fund giant BlackRock.

2. “We’re trying to create — we will create — a global business which could be one of the biggest things to come out of the UK for years — Google, Facebook, that sort of size.”

UPDATE:

How one London wine bar helped Brazil to cut crime | Madhumita Murgia, FT. February 8, 2019

3. Gordon inherited Gordon’s Wine Bar in London from his father in 2003. In 2010, he decided he would take action against rampant pickpocketing by setting up, Facewatch

4. is being tested by a major UK supermarket chain, several major events venues and Humber prison in north-east England - which is using the system to spot prolific drug smugglers, said Mr Gordon. In Brazil, it has been used by three commercial centres since last May.

5. Mr Gordon built the system with three friends from his village in Hampshire and launched it with 50 retailers in the area around London’s Victoria railway station, including Co-op Food. By 2016, more than 20 police forces were working with Facewatch, but cuts to their budgets meant they had few resources to investigate the incidents being uploaded.

6. In 2017, the company, which has just raised £2.5m in seed funding, brought on a new chief executive, Nick Fisher, to sell its alert system across the UK and Brazil.

7. Facewatch’s system uses an algorithm from US company RankOne to match faces seen in real time by in-store cameras with watch lists of known criminals. The process takes a few seconds, and if a match is found, the business owner is notified by a mobile alert.

8. ...is about to sign data-sharing deals with the METROPOLITAN POLICE and the CITY OF LONDON police, and is in talks with HAMPSHIRE POLICE and SUSSEX POLICE. If the systems spots a serious criminal, the alert is sent directly to the police, rather than to retailers. Facewatch plans to charge roughly £2,000 per camera for a three-year licence, but said it is in “beta” mode, with most of its customers trialling its products.

MATCHESFASHION.COM: strikes progress with sales jump | Joanna Bourke, Evening Standard. November 14

DZ profile: Matchesfashion Limited

Business: luxury online retailer which stocks brands including Chloé, Alexander McQueen, Gucci, Balenciaga and Jimmy Choo. The founders opened their first boutique in Wimbledon in 1987 and were the first retailers in the UK to stock Prada. The online business now ships to 167 countries and there are four London shops. At peak times, an order is taken every seven seconds.

Launched: 1987

Location: It doubled the size of its London headquarters in the summer with a relocation to The Shard from Clapham.

Founders: Tom and Ruth Chapman

Staff: In 2015 chief operating officer Ulric Jerome took over as chief executive. French-born Mr Jerome, 37 ...on the board of PADDY POWER and was a founding partner of PIXMANIA, the online retailer acquired by Dixons in 2006. In 2013, Dixons offloaded the company to German industrial group Mutares after it incurred heavy losses.

Financials: said turnover in the year to January 31 rose to £126.9m from £99.6m a year earlier. Losses fell to £1.7m from the £5.6m incurred when the firm invested heavily in technology.

Investment: Tom and Ruth Chapman own almost 70pc, with private equity investors SCOTTISH EQUITY PARTNERS and HIGHLAND accounting for the majority of the remainder. Matches received £20m in funding in 2012, which was used to rebuild its website and expand internationally.

UPDATE:

Matchesfashion.com on track for buoyant Christmas | Joanna Bourke,The Evening Standard. December22, 2017

1. ...on track for bumper Christmas sales, with customers buying luxury goods every six seconds. The firm said at peak times this month it has been selling 600 items an hour, up from 514 per hour in December last year. It said sales growth has been aided by investments in technology to make it quicker and easier to buy online. In the six weeks to December 10 there was a 103% surge in purchases made using the firm’s app. The average order for Matchesfashion’s 90-minute delivery service in London is £1,748.

2. ....busy year for Matchesfashion. The Chapmans sold a majority stake to funds advised by private equity giant APAX PARTNERS in September for a rumoured £400m, and the company recently unveiled plans to invest in a new east London tech and design studio.

BLUEBELLA: Lingerie brand set to roll-out bras across the US | Joanna Bourke, Evening Standard. November 16.

DZ profile:

Business: online lingerie retailer

Location: London

Founder: Emily Bendell

Financials: Bluebella is on track for sales to hit £1.7m this year, and £4.7m next year, helped by the US expansion.

Investment: has launched an equity crowdfunding campaign on Crowdcube to raise £500,000

News:

1. Bluebella is advertised by Queen drummer Roger Taylor’s daughter Tigerlily.

2. Recently secured deals from US firms Nordstrom and Bare Necessities to stock the firm’s goods and will ramp up advertising in California and New York next year, with plans to start selling 10,000 bras a month over there.