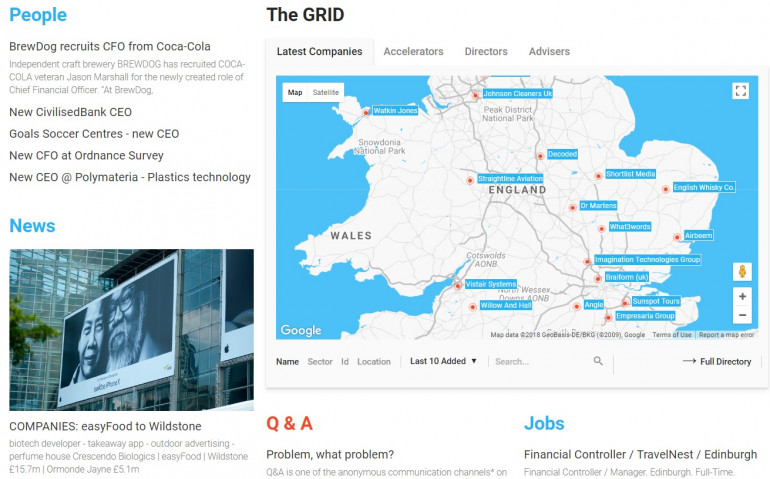

Published by Directorzone Markets Ltd on December 1, 2017, 8:36 pm in Knowledge, Market Info

Thursday February 14th 2019

EndsThursday February 14th 2019

Directorzone GRID company interview series: Ben Taylor, CEO and co-founder of RAINBIRD AI.

- The story: from prototype to AI powerhouse

- Innovation, Partner Acceleration and Government AI role

- The Future: raising capital, global expansion and changing the world.

- GRID co-ordinates and relationships

Rainbird story: from prototype to AI powerhouse

The names Babbage, Turing and Berners Lee testify to Britain’s historic and central role in the global digital revolution. Looking to the future, the UK’s importance in the hugely important Artificial Intelligence sector is reflected by the fact that four of the biggest AI startup acquisitions have been of UK companies - DeepMind (Google), VocalIQ (Apple), SwiftKey (Microsoft) and Magic Pony (Twitter).

Although the term ‘Artificial Intelligence’ was coined by American computer scientist John McCarthy back in 1955, the AI industry is very young and changing fast. The above acquisitions were all made during the short lifespan of one of the UK’s leading AI companies: Rainbird AI.

To find out more, Directorzone met Ben Taylor, CEO of Rainbird AI at its development centre in Norwich. In answer to the question: “What is Artificial Intelligence?”, Ben points to the AI paradox by quoting John McCarthy - ‘As soon as it works, no-one calls it AI anymore’ – and cites chess-playing computers and SatNav as examples of software that dropped the AI label a long time ago. He adds: “AI should just be called computerisation. The sooner we can get on with writing software and stop calling it AI, the better.”

Ben Taylor – the technology architect of the business - and his co-founder, tech entrepreneur and investor, James Duez, met at AI-powered startup, Validus, a claims management software company supplying the UK motor insurance industry. After a successful MBO lead by LDC in 2013, Ben and James left to set up Rainbird AI and embarked on an exciting journey, of growth fuelled by investors and partners that believed in Rainbird’s potential and innovation.

With seed investment, Rainbird built a prototype and launched a beta test for over 500 users. In 2014 Rainbird was chosen by the Techstars Accelerator programme, which invited 6 of the team to spend an intensive 3 months in London refining its technology and commercial model. During this process, Rainbird met 80 mentors, presented to 100 investors and started a series of funding rounds that brought in investment from the likes of Eden Rock, QVentures and Anglia Capital.

Market watchers such as the EDP Future 50, the Everline Future 50, Techstars and Pitch10 have been quick to recognise Rainbird’s success. Awards have come from Tech City Insider and in October, from Barclays with the East of England regional award in the Scale-Up Entrepreneur category. The company will now be entered for the national finals of the annual Barclays High-Growth and Entrepreneur Awards

Innovation, Partner Acceleration and Government AI role

With 80% of its sales in the UK, Rainbird is growing fast and expanding globally. Its main route to market is via resellers and it has partnered with powerful organisations that include IBM, Jardine Matheson and Mastercard. Rainbird partners are typically looking to use AI and cognitive technologies for client solutions and revenues. One of its solution partners is London-based Heron AI, which is also a subsidiary. Although Rainbird targets enterprise-level organisations predominantly, it does have an SME tier and also offers discounts to schools, universities and charities.

Ben Taylor: “A typical prospective customer may be using a decision tree technology for a business application, but in realising its limitations come to Heron AI, who will say you need Rainbird to provide the decision and IBM Watson to provide the chatbot interface”

Although applicable to business processes and problems across the spectrum, Rainbird software is particularly welcomed in sectors that are subject to strong regulation, such as financial services, banking, insurance and legal. Medicine is an obvious area for Rainbird software, although there are liability issues to consider.

2 examples of major compliance issues are:

- The Modern Slavery Act, which demands that businesses publish a ‘slavery and human trafficking statement’ for each financial year, and imposes obligations on their supply chain. In response to this, international law firm Taylor Wessing uses Rainbird’s software to provide new online legal solutions, win client business, and to improve its client service.

- The General Data Protection Regulation (GDPR), enforceable from 25 May 2018, which is designed to strengthen and unify data protection for all individuals within the European Union (EU) and to control the export of personal data outside the EU.

Ben Taylor: “It takes our current data protection legislation, but extends it quite significantly. Everybody should be worried about it - regardless of the size of your organisation – but particularly large enterprise, which face significant headaches and huge fines. Regardless of Brexit, the Information Commissioner's Office (ICO) has said that we will align to the GDPR.” The GDPR will, for example, allow citizens to demand an explanation for credit scoring decisions and this will cause huge workload for companies using Machine Learning systems.

Rainbird describes its software as a Cognitive Reasoning Platform – ‘Less artificial, more intelligence’ - and a decision-making technology. Ben Taylor outlines 3 unique strengths to explain why customers choose Rainbird:

- EVIDENCING DECISIONS. This is a key differentiator for Rainbird, especially with competitors that rely on Machine Learning technologies and are unable to ‘evidence’ decisions – i.e. explain clearly how each decision is reached. This ability to provide an audit trail – “human down instead of data up” - is very important in regulated sectors where building trust in the decisions made is vital. Ben Taylor: “Most loan credit scoring is done using Machine Learning, but it can’t be evidenced” to answer questions like ‘Why was this loan approved?’ or ‘Why was this client rejected for this product?

- The way Rainbird deals with UNCERTAINTIES, PROBABILITIES AND NUANCE when modelling any business environment or marketplace. Its visual modelling interface allows experts to display whatever is important to the business - concepts, relationships, facts and rules – into a Knowledge Map. These rules can also be ‘probabilistic’ where the degree of certainty and applicability can vary to create models that cope with uncertainty and missing data.

- Building EXPERT SYSTEMS. Using this visual structure, Ben Taylor says: “we solve the ‘Knowledge Elicitation problem’: how to model the expertise that resides in your company. Nobody else does this. Because of its open architecture, these systems can be linked to external data sources, be published and either queried directly via a chat interface, or integrated into other software to act as a sub-worker application, capable of making complex nuanced decisions.”

According to Ben Taylor, these strengths mean that Rainbird doesn’t have a huge amount of competition: “There are organisations in specific sectors that have point solutions that try to solve the same problems”. Some of these are listed at the end of this article.

Investors and partners are central to Rainbird’s growth plans, but what about Government and more specifically UKTI (UK Trade and Investment) support? Ben Taylor: “UKTI should be making AI a key part of UK export strategy but is, unfortunately, massively behind where we are.” To illustrate this point, he mentions a recent email from UKTI to say that they are sending a trade delegation to the 7th AI summit in New York – ‘the world's number one AI event for business’ - in December, and to ask if Rainbird was interested in coming along. Rainbird has been listed as an exhibitor and sponsor of this event for a long time…

“They’re taking some of the right initiatives in AI in general, but there’s more that the (British) Government should be doing: trumpeting the cause, making it a key part of our exporting strategy and encouraging overseas investment in this space. The UK is a world leader in AI and we don’t do enough to make the most of that internationally.”

Should the Government create an AI catapult (to add to the other 7 industry ones)? “Absolutely!”

The Future: raising capital, global expansion and changing the world.

As the interview comes to a close, Directorzone asks what is on the horizon for Rainbird AI and to hear some of the items on its ‘shopping list’. Here is a selection:

- Rainbird is actively looking for PARTNERS in North America. Criteria:

- Software houses working with large enterprise customers;

- Organisations with AI consultancy or delivery capability;

- Also IBM Watson partners.

- STAFF. Rainbird is currently investing in a new marketing team and will recruit some more sales people in the next 12 months. There will be a small investment in extra development and consultancy staff. Overall, not more than 5 -10 extra headcount. There are a number of factors that could change this…

- Rainbird will incorporate in HONG KONG soon, which – depending on key projects with partner Jardine Matheson - may necessitate putting boots on the ground there with small office of 3-4 people. The Asia-Pacific AI marketplace is perhaps 18 months behind the US and Europe – because of issues of natural language processing technology - and this means that Rainbird and Jardine Matheson have an opportunity to become market leaders there.

- Rainbird is also seeking:

- Additional PATENT PROTECTION

- Additional SCIENTIFIC ADVISERS, with a background in cognitive sciences or AI, on the Rainbird Advisory board.

- PHD RELATIONSHIPS, in the longer term, with Rainbird offering co-sponsorship of Phd research.

- Raising capital in 2018:

- Rainbird is planning a series A institutional FUND RAISING in Q3 2018 with European and/or US VCs. Directorzone asks, hypothetically, if Rainbird were seeking funding of £10m and got offered £100m, would that be 10 times better? Ben Taylor: “No. That does happen. I’ve had almost that exact discussion, but there are costs and there’s a risk of getting fat, lazy and building a business that’s bloated. Also, when you’ve done several investment rounds, as we have, more dilution becomes harder to justify to your existing shareholders. It also means that what you need to achieve in terms of recurring revenue is higher.” The goal is “taking the capital that you need to grow sensibly, sustainably, and to build a business that has the value that you want it to have.”

- LISTING is certainly an option sometime next year, and would constitute a degree of exit. Could listing offer Rainbird an accelerated growth? Ben Taylor: “Yes, I think it could….” adding, however, that Rainbird is cautious about this, given the reporting burden on management and citing examples of companies that listed too early on AIM and nearly went under.

- Directorzone: arguably, every company is for sale? Ben Taylor “You don’t build a high growth and scale-up business like this without looking for an exit of some description. Our focus isn’t on acquisition - what I’m trying to do is to build a business that is valuable and then we can think about what happens next.”

Final Directorzone question: how would you like to change the world (beyond Rainbird’s current innovations)?

Ben Taylor: “There’s a way that Rainbird could go, that we’ve never pushed on. If the question is ‘if I could do anything that could be world-changing, what would it be?’, we’ve always had this idea that expertise is a scarce resource and Rainbird is a unique platform for modelling expertise. Wouldn’t it be interesting if you could open up that expertise to some kind of marketplace and exchange for expertise.

Not only is that commercially interesting – with an app store take 30%-type model – but philosophically its extremely interesting, because suddenly every expert has access to this huge repository of expertise. It would be an interesting thing for us to pursue, but building a marketplace is very hard and it’s a question of priorities and focus.”

GRID co-ordinates and relationships

Founded: 2013

ICB Sector: Software

Location: London and Norwich

Staff: 30, with 10 consultants

Investment: Over $5m + undisclosed amounts to date (source: Crunchbase)

Customers (selection):

Over 20 customers – mainly large enterprise-level - including:

- DELOITTE, international accountancy and consulting firm

- FLUID MOTION, Community Interest Company (CIC), Hydrotherapy and healthcare innovation

- TAYLOR WESSING, international law firm.

Partners and resellers (selection):

- HERON AI - technology-agnostic consultancy (Rainbird subsidiary)

- AI EXCHANGE (AI-X) - AI trading broker in cryptocurrencies and other financial markets

- AJBURGESS - AI and Robotic Process Automation consultancy

- BEARINGPOINT - helps businesses transform customer experience and operations

- CLUSTRE – innovation brokers

- FILAMENT - AI and machine learning

- GML CONSULTING - digital agency

- HUMLEY - deploying and training AI systems

- JIGSAW - change consultancy

- JOS - IT services and solutions, with 2,200 IT professionals in China, Hong Kong, Macau, Malaysia and Singapore. Member of the Fortune Global 500-listed JARDINE MATHESON GROUP

- MASTERCARD - global payments

- MIND-ALLIANCE SYSTEMS - knowledge systems and intelligent analytics solution

- PIVOT - SAP consultancy

- PROTIVITI - global consulting

- REALISE - digital agency

- RABBIT & TORTOISE - technology solutions, based in Pune, India

- THE BAKERY - innovation consultancy.

Suppliers (selection):

- BARCLAYS

- XERO

Competitors (selection):

- IP SOFT – autonomic and cognitive Machine Learning technologies. Key product: Amelia.

- MOTION.AI - AI tool for building chatbots. Recently acquired by HubSpot.

- NEOTA LOGIC –- AI software platform. Decision tree technology. Targets the legal sector.

Investors:

- 500STARTUPS

- ANGLIA CAPITAL GROUP

- EDEN ROCK CAPITAL MANAGEMENT LLP

- FORCE OVER MASS

- QVENTURES

- TECHSTARS

- Theo Osborne

- Wayne Churchill

- John Bradford