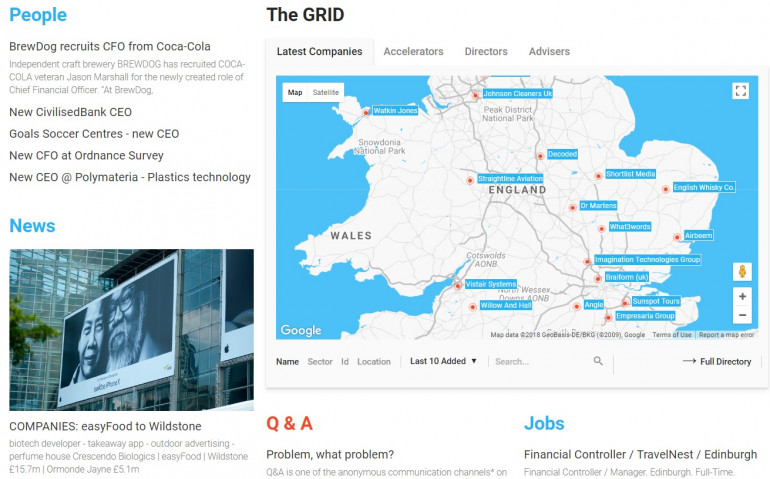

Published by Directorzone Markets Ltd on July 9, 2018, 9:00 am in News, Other

Thursday February 14th 2019

EndsThursday February 14th 2019

IMAGE: courtesy of Pixabay on Pexels

gin distillery

- DIY laptops –

financial markets analytics platform

London x 3

Sipsmith £8.6m | pi-top | Quant Insight (QI)

News about 3 UK growth companies and/or accelerators + turnover in the GRID marketplace 1st -7th July 2018:

SIPSMITH: gin distillery - London

Sipsmith is just the spirit for childhood friends | Liam Kelly, The Sunday Times. July 1 2018.

DZ profile: Sipsmith Limited

Business: Distillers that sell upmarket gin. In 2009 created London’s first new copper-pot distillery for nearly 200 years and won a contract to sell their gin at a single Waitrose in 2010. Exports to over 40 countries, and its range of six drinks includes vodka. Have 3 stills: Prudence, Patience and Verity.

Launched: 2009

Location: Chiswick, London

Founders: Sam Galsworthy, 42 and Fairfax Hall, 43. Before the launch, Galsworthy was export manager for the brewer FULLER’S and Hall was a strategy consultant for Guinness owner DIAGEO. They sold their flats to launch the business, raising funds from friends and relatives to their first still for £180,000.

Staff: 50

Financials: pre-tax profits of £76,000 on £8.6m sales in 2016. Last year, reportedly, sales more than doubled and profits are now into the millions.

Investment: sold a controlling stake in 2016 to the Japanese liquor giant BEAM SUNTORY, whose brands include Laphroaig and Courvoisier.

PI-TOP: DIY laptops - London

This man has just been named London's top entrepreneur of 2018 | Emily Nicolle, City A.M. 5 July 2018

DZ profile: Ceed Ltd (pi-top)

Business: wants to make coding and experimenting with building electronics fun for kids, and affordable for schools. The startup designs and manufactures computers and other related technology, providing hardware, software and lesson materials to more than 2,000 schools in over 70 countries.

Launched: 2015

Location: London HQ, with offices in Austin, Texas, USA and Shenzhen, China

Founder: Jesse Lozano, 29 - who EY has named as London's overall entrepreneur of the year for 2018 – and Ryan Dunwoody.

Staff: 80+

Investment: Series A, Nov 2016, £3.5M: Volker Hirsch / EMERGE EDUCATION, HAMBRO PERKS and COMMITTED CAPITAL. Jan 1, 2015 Seed funding, £25K.

UPDATE:

pi-top Closes $16 Million Funding Round | Businesswire. July 13, 2018.

The investment, led by Hambro Perks and Committed Capital, brings pi-top’s total funding to $22.5m to-date.

QUANT INSIGHT (QI): financial markets analytics platform - London

City tycoon Alan Howard joins multi-million dollar round for AI tech startup Quant Insight | Emily Nicolle, City A.M. 5 July 2018.

DZ profile: Quant Insight Limited (QI)

Business: AI-driven financial markets analytics platform that aims to give traders an edge in picking winning bets across stocks and indexes. Developed by a group of former investment bankers, data engineers and Cambridge University academics, QI combines investment expertise with data algorithms and machine learning to deliver an analytics web platform that provides investors with actionable insights on their trades. Its client list of 150 hedge funds, pension funds and other institutions has increased by 50 per cent this year.

Launched: 2014

Location: London

Founders: Krishnan Sadasivam, ex-partner and macro portfolio manager at Brevan Howard and Mahmood Noorani, who worked at UBS, Bluecrest Capital Management and Citi Capital Advisors. The two worked together at MILLENNIUM CAPITAL PARTNERS in their last positions before launching QI.

Staff: 25

Investment: AH FUND owned by Alan Howard - hedge fund billionaire and co-founder of asset management firm BREVAN HOWARD - has backed a series B investment round. AH Fund invested £4m in AI startups and fintech personal investment app ARKERA in April earlier this year. Additional backing from Jens-Peter Stein, STONE MILLINER ASSET MANAGEMENT. 80 per cent of the capital in the funding round came from QI clients. The funding will be used to boost growth in the US and Asia.