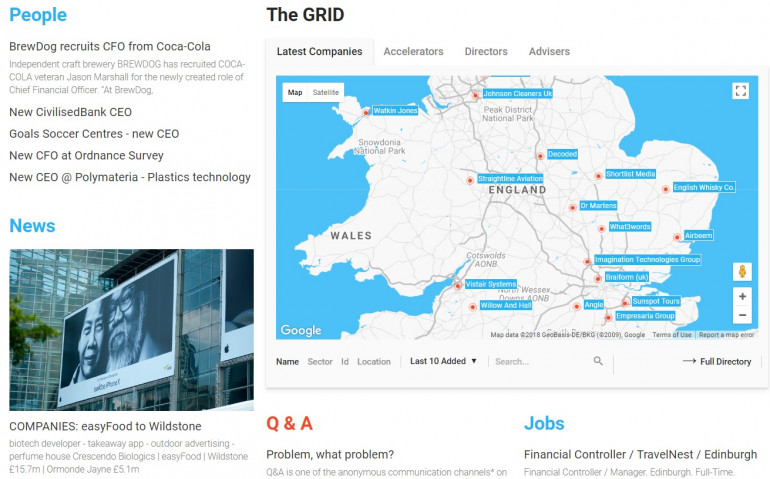

Published by Directorzone Markets Ltd on May 23, 2018, 5:57 pm in Knowledge, Market Info

Wednesday January 1st 2020

Directorzone GRID company interview series: Dr. Jim Shaikh, CEO of Feed Me Bottles (yoomi)

- Defying business gravity

- Engineering and product innovation

- 24x7 vigilance

- Go Global, embrace China

- What’s next?

- GRID co-ordinates and relationships

Defying business gravity

Some journeys can make or break you.

The YOOMI story reads more like a corporate thriller than the MBA case-study that it should also be. It has survived epic cash burn, competitor dirty tricks, python-like squeezes from major customers and a factional shareholder issue. After supplier price-gouging and critical delivery failures, its staff training guideline is “don’t trust people outside the business to do their job properly, so keep checking”.

It also succeeded in bringing innovation - that is still unique and unrivalled - to its segment of the baby care market. Yoomi makes self-warming baby bottles and other products.

It built its business around its first order in 2009 when JOHN LEWIS – in a massive vote of confidence – ordered £10,000 worth of stock, and then £30,000 more when the first delivery sold out in 10 days. It went on to cut deals with MOTHERCARE and BOOTS, challenging big, established suppliers such as PHILIPS AVENT and TOMMEE TIPPEE.

Yoomi found out that playing with the big boys in the UK market - which is centred around a small group of supermarket chains, department stores and specialist retailers - requires big pockets. It also found out that product innovation counts for a lot less than the next 12 month’s marketing budget with hard-nosed corporate buyers. This 2017 proposal from one of its big ex-customers – in return for selling the product at just 20% of all its UK stores – illustrates some of the barriers to entry:

- 60% margin on the sale price to the retailer

- 90-day payment terms and a further 3.5% settlement discount when payments are made

- £90,000 additional up-front contribution to in-house retailer marketing (web site, magazine, etc.), regardless of sales made

- Further supplier discounts on the sales margin at 4 retailer baby care events a year.

Unable to continue paying the piper, Yoomi pulled out of the big UK retailers and now makes 85% of its sales overseas. 13 years after its first patent, it has 40 investors, is profitable and is growing fast. Its £500,000 turnover is forecasted to reach £700,000 in 2018. But its survival has repeatedly defied the laws of business gravity.

Engineering and product innovation

The Yoomi story started with a young Imperial College London graduate who won a PhD scholarship to Cambridge and went on – 7 years later - to do an MBA at London Business School. This background helped him to set up IFS, a successful engineering consultancy which became a springboard for a much more ambitious and entrepreneurial project.

Yoomi is a family business run by CEO Dr. Jim Shaikh with his wife Farah - effectively the CFO and legal counsel. In 2002, in response to the premature birth of their first son, who needed to be fed every 2 hours, Jim and his engineering team designed its flagship product – the world’s first rechargeable self-warming baby bottle. Its principle innovation is the phase change technology that allows only the milk that the baby is drinking to be warmed to a perfect temperature, rather than - as with competitor products - the whole bottle. This Yoomi (‘You’ – the mother, and ‘Me’ – the baby) technology protects the mother’s milk from losing vital nutrients and includes an endlessly re-usable product that doesn’t need electricity.

After years of designing, patenting, prototyping, testing new materials, tooling, ‘productising’ and working with multiple manufacturing suppliers, Yoomi has honed the production process, reduced its outsourcing and now works with 3 main suppliers in China, South Africa and Bulgaria. It has reduced its cost per unit by 75% since 2007 and improved its product. From a peak of 18 staff, it now has just 7, supplemented with part-time staff for in-house product assembly and packaging.

Yoomi’s board of directors – sourced from its investors – has also evolved with the company: from a pre-Lehman Brothers crash “sell at any cost and work towards a trade sale” mentality to a more pragmatic, profit-conscious group.

24x7 vigilance

Jim Shaikh’s MBA helped him to shape his business plan and strategy that won over his first investors – through the LBS Enterprise 100 – and secured match funding through the DTI and the London Development Agency. This brought in the first £240,000 of the £3.5m that has been raised over the last 12 years.

Many of Yoomi’s most important business lessons were, however, learned the hard way. Some of the its formative moments have included:

- SUPPLIERS. Learning that regular supplier churn is inevitable in order to get the right level of service.

- During the lead-in to fulfilling its first order in 2009, finding that the new plastic wonder material from and large US plastics supplier for its plastic bottles caused the bottles to crack when boiled (response: “OK. Sue us”).

- Then finding shortly afterwards that an unannounced upgrade of components from another supplier caused the bottle technology to fail. This necessitated a complete product re-tooling and finding an immediate replacement supplier at 5 times the cost.

- Yoomi discovered that representing only 1% of the business of any given UK supplier, means exposure to impromptu price hikes, late deliveries and major quality control issues. This caused Yoomi to cancel major supplier contracts on 3 occasions and to seek overseas suppliers, particularly in China.

- One key early learning in China was to get different components manufactured by different companies and then assembled back in the UK – thus avoiding copying and the “one for me, one for you” siphoning of products on to the black market. For similar reasons, the strategic warmer components were manufactured outside of China.

- Every single one of Yoomi’s 24 overseas distributors have been changed at least once.

- The company changes its FX brokers regularly, to avoid the inevitable erosion of ‘regular’ customer terms.

- Yoomi quickly appreciated the humour in banks advertising about how much they care about their customers.

- CASH BURN: moving from £30,000 to £80,000 a month 6 months later, in order to fulfil the first critical John Lewis orders. Yoomi’s investors - who believed that their best option was a quick trade sale to a more established and richer company - urged Jim to “ride it” and to “fill the shelves”, despite the company haemorrhaging cash.

- COMPETITION. Facing a ferocious response from multinational competitors, including 50% plus price reductions, “channel blocking” - offering inducements to retailers not to stock Yoomi – and a sustained “dirty tricks” campaign. This involved opening large numbers of Yoomi products in major retailers, creating a wave of returned products.

- CUSTOMERS. Realising that its big customers play suppliers off against each other in order to obtain better deals especially from the bigger competitors.

- ADVISERS. Learning to hold professional services firms – lawyers and accountants – to tight charging frameworks, with real time disclosure of hourly billing. Also, to watch out for “value pricing” - getting much higher than agreed invoices, because the firm decides that its service has generated a higher value for the company. Yoomi found that regional (as opposed to City) firms offer the biggest mismatch in terms of costs and value, and also that it helps if the CEO’s wife is a lawyer…

- IP STRATEGY. Learning how to design a patent portfolio that protects its Intellectual Property. Investors have always been most concerned about IP and how soon the technology can be copied. After its initial patent application in 2005, Yoomi had 2 years to raise the £40,000 needed for adequate worldwide coverage. It was lucky in its choice of IP lawyers - Stevens Hewlett & Perkins – and in having the enthusiastic support of one of the SH&P; founders. A lot of Yoomi’s technology is in shape and form, so rather than going for expensive technical patents everywhere, it did so in core countries and applied for design patents in a wider range of countries. Yoomi now spends significant sums on a yearly basis keeping its patent portfolio up to date.

These experiences have helped Yoomi to embrace a policy of 24x7 vigilance in honour of Murphy’s Law – ‘what can go wrong will go wrong’.

Go Global, embrace China

After its baptism of fire in the UK marketplace, learning how to do international sales was a key element in Yoomi’s survival and strengthening its business. Currently, worldwide Yoomi sales are divided between these territories:

- China - 50%;

- Western & Eastern (Czech, Poland, Balkans, Baltics, Turkey and Russia) Europe- 19%;

- UK - 15%;

- Middle East & Africa (Iran, Saudi Arabia, UAE, Lebanon, Jordan, South Africa) - 7%;

- Asia & Australasia (Japan, India, Vietnam, Australia, NZ) - 7%;

- US and Latin America (Chile) - 2%.

Jim Shaikh says that support from UK Trade & Investment - the Government department helping UK companies in international markets - has been variable, the OMIS country reports (for Germany, Spain and South Korea) did not provide solid sales leads, but the Advisors could be very helpful when engaged with the business. This is, he believes, because UKTI has limited resources, a vast brief and a team of variable quality. He found that Export Finance was only for large companies but that the Manufacturing Advisory Service (MAS) was very effective, providing 2 grants to reduce the costs of marketing professionals for the Chinese marketplace.

During our conversation, the subject of China cropped up many times. Jim spends 10 days a quarter in China and knows his way around Beijing, Shanghai and Shenzhen quite well. Chinese suppliers were key elements in Yoomi’s ability to build a competitive and affordable product. 50% of Yoomi’s worldwide sales are now in China, a Chinese investor invested in the company 5 months ago and a new Yoomi partner for applying its technology in brand new markets is Chinese.

What’s next?

Jim Shaikh wanted to use his engineering skills to build a consumer business and a brand. He succeeded. Yoomi is now a lean, profitable business with a very efficient operation. It doesn’t hold stock and it’s just-in-time model is fed by tried and tested suppliers. With 85 % of sales taking place overseas and most of its UK sales online, it has great margins and a strong platform for growth.

Some of its immediate priorities include:

- Finding fitout companies for a move to new premises with a 5-year lease

- Finding a better international banking service with RNB account and FX services

- Launching a new marketing campaign with new web site, brand refresh and PR campaign over the coming months to boost Yoomi’s presence in the UK online marketplace. Whereas Yoomi initially emphasised the convenience of its products, it is now focussing on their powerful health advantages compared to competitor products.

- Based on the success of this strategy, applying what it learns by expanding Yoomi’s presence in the US online marketplace.

- Exploit opportunities for further overseas growth, particularly in the Asian, Middle East and Russian marketplaces.

- Start new partner discussions with a view to:

- Incorporating new 3rd party products and technologies – hardware and software - that fit with the Yoomi brand in the baby care marketplace.

- Applying Yoomi’s warming technologies to new products in the medical devices and battlefield marketplaces.

Yoomi’s journey has been one of huge challenges and quite a few “should we just throw in the towel” moments. It’s a heroic story of success against daunting odds.

We wish the company every success in extending its brand, technology and managerial know-how into new markets and in achieving the accelerated growth and profitability that it richly deserves.

GRID co-ordinates and relationships

Name: Feed Me Bottles Limited (trading as Yoomi)

Founded: 2006

ICB Sector: 3767 Personal Products

Location: Dartford, Kent

Staff: 7

Investment: £3.5m to date

Revenues: £500k (2018 forecast £700K)

Profitable: Yes

UK Customers (selection):

- Amazon

- Argos

- BabiesRUs

- Home Beauty & Gift Shop

- JD Williams

- The Kids Division

- Oxendales

- Marisota

- Superdrug

Partners and resellers (selection):

- TomTop (China)

- Les Meres Nature (France)

- Medisurge (PTY) Ltd (South Africa)

- Flat Out Mum (Australia)

- Babypoint (Czech R)

- Gold Concept (Poland)

- Friendly Fox (US)

Suppliers (selection):

- Clareville PR

- Lloyds TSB Bank PLC

- Principles Marketing

- SH&P; - Stevens Hewlett & Perkins (Patent & Trade Mark Attorneys)

Competitors (selection):

- Philips AVENT (UK)

- Tommee Tippee (Mayborn Group - UK)

- iiamo (Denmark)

- Pigeon (Japan)

- Chicco (Italy)

- Nuk (Germany)

- Dr. Brown; Playtex (US)

Investors (selection):

- IDEO LLC

- Douglas Hursey, Chairman