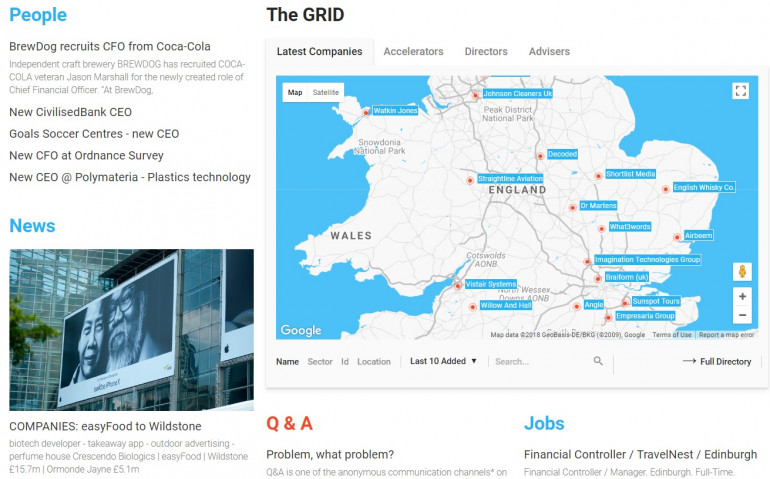

Published by Directorzone Markets Ltd on April 3, 2017, 9:00 am in Knowledge, Other

Wednesday January 1st 2020

Reshoring UK Manufacturing | Northern Tech Investment | Satago & Crowdfunding Questions | Banks: Apps, Challengers & Big 5 | Metro Up, Print Advertising Down | Lending to SMEs in Decline

Digest of news and trends in the GRID marketplace in March 2017:

RESHORING UK MANUFACTURING

Is it time to find a factory that’s closer to home? | Laura Onita, The Sunday Times. March 26

Rising costs in China and currency shifts can make local production a better option

Several British campaigners are now trying to promote local factories to small businesses, to kickstart a manufacturing renaissance. Kate Hills, a former buyer for Burberry and Marks & Spencer, launched MAKE IT BRITISH, a platform that brings together start-ups, factories and retailers, in 2013. In the first 10 weeks of this year, 14,500 people tried to find a factory via her website compared with about 6,000 during the same period last year.

Companies want to get their wares to market much quicker to keep up with trends, said Hills. Local makers mean shorter lead times. Manufacturers are thriving on the favourable exchange rate, she added.

A survey last week showed that 57% of small factories have grown orders since the vote to leave the EU. Two-thirds expect revenues to rise in the first half of this year, boosted by the weaker pound making goods more competitive overseas.

….the EEF’s (manufacturers’ trade lobby) Make it Britain initiative encourages companies to bring production back to this country. It estimates that one in six businesses have “reshored” part of their operations in recent years. If more follow, the UK economy could get a £15bn boost by 2025, according to accountants EY. However, critics warn that skills shortages are a big barrier and the number of companies returning to Britain remains small.

A new £10m fund was launched last month by the MANUFACTURING GROWTH PROGRAMME to help small factories such as O’Neill’s (ALBION KNITTING COMPANY) to streamline production. Manufacturers in the West Midlands, East Midlands and the east of England can apply for grants, training and advice. The scheme, backed by EU money, is meant to fill the hole left by the closure of the Manufacturing Advisory Service two years ago. It had helped tens of thousands of companies since it was set up in 2002.

NORTHERN TECH INVESTMENT

Northern tech stars look south for cash | Kiki Loizou, The Sunday Times. March 19

New data from Tech North, an arm of the government’s Tech City UK, shows that 2016 was a record year for investment into north of England technology ventures. Numbers from PITCHBOOK, a database of Britain’s private equity and venture capital deals, show £326.9m was pumped into companies in the north of England via 74 deals last year — an increase of more than 1,500% over 10 years. Yet the numbers are still small and deals few when compared with the capital.

According to LONDON & PARTNERS, the capital’s promotional agency, almost 75% of the £2bn that found its way into UK technology ventures last year went to London businesses.

Moreover, the growth in the north is attributable in part to a few companies raising big wads of cash. According to PitchBook, of the £330m invested last year, £135m was raised by ATOM BANK, the online-only bank based in Durham. Ecommerce company the HUT GROUP, headquartered in Cheshire, notched up £100m of the total. “A few large deals can skew the figures, but it is clear the trend shows investment increasing in the north,” said James Bedford, head of investment strategy at TECH NORTH.

There are some funds serving the north of England. Among them are the so-called JEREMIE FUNDS, EU-backed and providing a mixture of equity and debt finance to small and medium-sized businesses. They include the £120m NORTH EAST FUND, the £185m NORTH WEST FUND and the £400m NORTHERN POWERHOUSE scheme. About half the cash available comes from the EU and half is provided by the EUROPEAN INVESTMENT BANK.

Four of the 27 north of England companies backed by BGF are tech-focused. Of the 14 companies backed by BGF Ventures, the fund’s cash pot for tech start-ups, 13 are in London and one is in Bristol.

SATAGO & CROWDFUNDING QUESTIONS

His slogan was ‘F*** You, Pay Me!’ Now that’s what his creditors say | Kiki Loizou, The Sunday Times. March 12

… increasing questions about crowdfunding. NESTA, a charity that champions innovation, has suggested about 60% of the people backing companies on the sites are inexperienced investors with little knowledge of the perils of ploughing cash into risky start-ups. Research by AltFi, which studies alternative-finance data, found that out of 751 businesses to have raised money on platforms such as Crowdcube or Seedrs, investors had made a successful exit from only five.

SATAGO, a financial technology company, is the latest in a string of recent crowdfunding failures. Lick, the frozen-yoghurt business that raised a six-figure sum on Crowdcube, is now in liquidation. FEEL FREE, a maker of gluten-ree food and another Crowdcube-funded business, is in administration. In total, more than 400 investors backed the two ventures via the platform.

Satago has gone bust after burning through more than £4m in four years. Satago which devised an online system to help ease cashflow problems for small firms, was placed in administration last month after running out of cash. Founder Steven Renwick …..failed to hit performance targets that would have triggered the next tranche of investment from venture capital firm ESF CAPITAL. According to abbreviated accounts filed at Companies House, the company’s losses worsened from £190,000 to £630,000 in 2015.

Betfair founder Ed Wray and William Reeve, co-founder of LoveFilm - two of Britain’s best-known angel investors - were among the early backers of Satago, which was launched in 2012.

More than 80 other private investors backed the London-based start-up through the crowdfunding platform SEEDRS. Satago was one of the first companies to use the site and rustled up about £50,000 through three campaigns. In total, the business raised more than £1m of equity and £3m of debt. Seedrs, which has so far raised £190m from 460 fundraising campaigns, said: “The substantial majority of early-stage businesses will fail. That’s the nature of the asset class, and it’s just as true of crowdfunded businesses as those that raise money from angel investors or venture capitalists.”

It has agreed a pre-pack sale with OXYGEN FINANCE, which sells payments services to businesses. Satago’s 10 employees are all thought to be working at Oxygen, but investors, which also include SEEDCAMP and the New York-based venture capital firm BDMI, are not expecting to retrieve their cash.

Satago offered up to £500,000 in invoice finance to more than 1,000 small business customers. It fast-tracked cash to firms that were waiting for bills to be paid by big corporate customers. Although this is a traditional financial service — one provided by banks — Satago claimed to have a new, data-driven way of assessing credit risk: to collect data directly from participating SMEs and freelancers on their actual experience of how larger companies have paid them …anonymous information so that participants need not fear reprisals from customers. As the database expanded, each company was to get an overall “payment behaviour score”, which Mr Renwick hoped that would put increased pressure on big business to “play much fairer” with their suppliers.

The Government launched its own initiative — the PROMPT PAYMENT CODE — asking FTSE 250 businesses to sign up, committing themselves to paying their bills to suppliers in accordance with the agreed terms.

BANKS: APPs, CHALLENGERS & BIG 5

New-generation UK banks challenge with technology | Emma Dunkley, FT. March 10

… range of app-based banks emerging in the UK as the latest wave of new competitors to the large established lenders.

They are not the challengers the industry expected six years ago, when an overhaul of UK retail banking attempted to break the hold of the dominant five lenders. But, as the larger “challengers” have stalled this new breed of digital-only banks, with slick technology and low costs, is gaining traction.

A number have gained licences from the regulator in the past year and are set to launch in the coming weeks. These so-called neo-banks are tiny — ATOM BANK, for example - launched by one of the founders of Metro, was the first to emerge last year - has 14,000 savings accounts. But unlike traditional high street banking services offered by branch-based challengers such as METRO, TSB and VIRGIN MONEY, they are offering customers the ability to manage their own money with an app.

They are built with modern technology that allows them to plug into external services, such as lending, investing or shopping from other providers and rival banks. By analysing customer spending data and habits, these banks can offer customers deals by linking up with retailers or coffee shops, for example, in return for a referral fee.

STARLING and MONZO are two examples that have gained a licence to operate and will focus on providing a digital current account and money management services.

Ricky Knox, founder of TANDEM, another bank preparing to launch that will also focus on money management, says: “Airbnb didn’t go after the hotel market, but everyone’s spare room. We’re not going after banking, but everyone’s personal finances. The opportunity as we see it is that your bank is not trying to help you with your personal finances.”

It is still too soon to assess the impact of the digital-only banks, given many are yet to launch and others are at an early stage. They are not expected to take a significant share of the market from the biggest banks. But they could be helped by problems afflicting some of the more traditional challengers that were supposed to rebalance the market away from LLOYDS BANKING GROUP, ROYAL BANK OF SCOTLAND, BARCLAYS and HSBC.

….challenger banks, while growing their deposit and loan books, have struggled to gain current account share from the biggest lenders, with the number of customers switching still a tiny fraction of the market. TSB, for example, which was hived off from Lloyds and floated after the failed Co-op sale, has been restricted to a degree by Lloyds’ IT systems.

Some smaller banks are now changing tack, in moves that emulate the digital start-ups. CLYDESDALE and YORKSHIRE BANKING GROUP has unveiled B, a money management tool that sends prompts to customers when they are about to enter their overdraft and provides discounts at shops.

Tim Levene, founder of AUGMENTUM, a fund backed by Rothschild, says that the more traditional challengers still face obstacles: “Unless Facebook, Amazon or Google decided to enter the UK banking market, which is not impossible, it will take quite some time and a significant amount of capital to seriously eat into the massive market share that the big banks currently have”.

METRO UP, PRINT ADVERTISING DOWN

Metro becomes UK’s most-read daily newspaper | Henry Mance and David Bond, FT. March 8

Metro, the free morning tabloid paper which relies solely on advertising revenues is part of the DAILY MAIL GROUP … launched in 1999 to prevent Sweden’s Modern Times Group from entering the UK market and taking advertising share. Metro is unique in remaining neutral on the big political issues, from Brexit to the Budget. It has now overtaken The Sun and the Daily Mail to become the country’s most-read daily print paper, with an audience of 10.4m a month, according to the National Readership Survey.

Despite its popularity, the paper faces financial challenges. Its revenues were £65m in 2016, compared with £484m earned by the Daily Mail and the Mail on Sunday. That represented a 9 per cent fall for Metro, compared with a 3 per cent drop for the paid-for titles. Unlike its sister papers, it is unable to raise cover prices to fill the gap as advertisers increasingly switch their money to online platforms such as Facebook and Google. Analysts at Enders said print advertising fell last year by 15-20 per cent and are forecasting a similar run rate for 2017. Like other free publications — such as TIME OUT, CITY AM and the LONDON EVENING STANDARD — it is being hit by the weaker pound. Since the Brexit vote the cost of newsprint has jumped more than 8 per cent — from £330 to £360 per tonne — according to the print industry research firm EMGE.

…..the Daily Mail, The Mail on Sunday, MailOnline, Metro, This Is Money, Today I’m Wearing and You Beauty Box brands are trading styles of Associated Newspapers Ltd. which is part of the Daily Mail and General Trust plc group (“DMGT”).

LENDING TO SMEs IN DECLINE

Bank said no, but I didn’t lose my sense of hummus | Kiki Loizou, The Sunday Times. March 5

Banks must now direct applicants they reject to other sources of finance. Under the Small Business, Enterprise and Employment Act 2015, Britain’s nine biggest banks are required to refer possible borrowers to websites that pool information about alternative lenders.

The main sites are FUNDING XCHANGE, BUSINESS FINANCE COMPARED and FUNDING OPTIONS, listing peer-to-peer lenders, government schemes and challenger banks that could provide the cash for smaller companies.

The system went live in November but the number of referrals so far is low. The government’s BRITISH BUSINESS BANK estimates that every year 100,000 small companies are turned away by high street lenders but, on current rates, only about 24,000 such rejects are pointed towards an alternative funder.

ART BUSINESS LOANS, which hands out more than £3m a year to small firms, has so far had no referrals via the new scheme.

Lending figures from the Bank of England suggest that net lending to small and medium–sized companies is in decline. In January last year, banks lent £236m to smaller firms. In the same month this year, the figure was a net minus £500m — banks collected more in repayments than they handed out.

Tellingly, in the last quarter of 2016, banks lent a net £220m to small companies, while peer-to-peer lender FUNDING CIRCLE provided loans totalling £167m. Funding Circle, now valued at more than $1bn, has its own referral deals with the likes of RBS and Santander, which could mean that firms turned away by those banks are not always aware of other options.