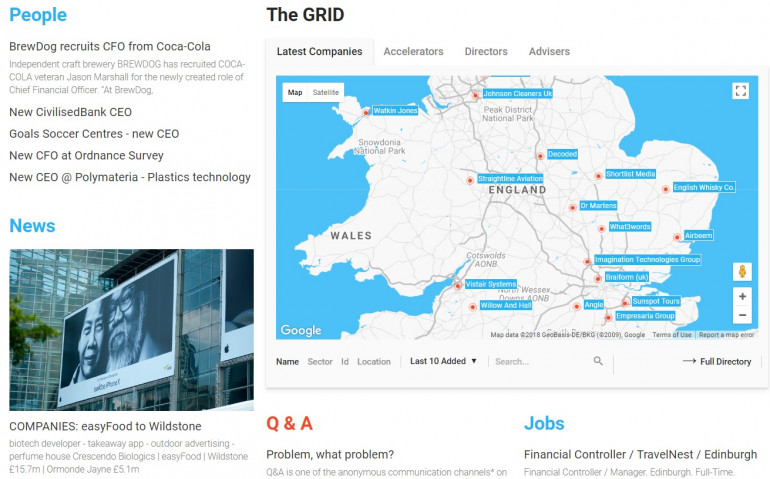

Published by Directorzone Markets Ltd on January 3, 2017, 9:00 am in News, Other

Thursday February 14th 2019

EndsThursday February 14th 2019

InstaVolt | Mirror Mirror £1.5m | Virginia Hayward £17.1m | Russell & Bromley £115m | Habito | GrooveMe | COOK £45m | Premier Decorations £37.2m

News about 8 UK growth companies and/or accelerators + turnover in the GRID marketplace, 18th – 31st December 2016:

INSTAVOLT: Car charger powers up | Sunday Times. December 18

DZ profile: InstaVolt Ltd

Business: has developed a “pay-as-you-go” device that allows most electric vehicles to recharge 80% of their battery capacity in 30 minutes. It hopes to roll out 3,000 of the machines by 2020. InstaVolt solutions allow local authorities, supermarkets, fleet providers and owners of infrastructure and land the ability to install EV infrastructure at no cost to themselves and receive an income for the next 30 years.

Location: near Basingstoke, Hampshire

Founder: headed up by Tim Payne, who co-founded energy efficiency firm Anesco and acted as COO before leaving and going on to set up InstaVolt.

Staff: chairman Adrian Pike, former Anesco CEO

Investment: has raised £12m from the venture capital firm Zouk Capital to install 3,000 electric-car charging points across the country.

News: UK take-up of electric cars has been slow, partly because of range anxiety — the fear of running out of power before reaching a charging point.

MIRROR MIRROR: Sisters end up doing the fundraising for themselves | Laura Onita, The Sunday Times. December 18

DZ profile: Mirror Mirror Couture Limited

Business: wedding dress design business. Clients have included Amanda Holden and Zoë Ball.

Launched: 1989

Founders: Maria Yiannikaris, 59 and her sister-in-law Jane Nicolls, 54. started making couture gowns in a spare bedroom, backed by a £12,000 bank loan.

Financials: Annual sales have reached £1.5m

VIRGINIA HAYWARD: Sweets for the children, fizz for the parents and a thriving trade in hampers | Laura Onita, The Sunday Times

DZ profile: Virginia Hayward Limited

Business: sells its own branded luxury hampers to the public and corporate clients such as Barclays and Vodafone, and sells wholesale to high-end retail chains. The hampers cost between £15 and £750. The company hand-packs and sells 400,000 hampers a year.

Launched: 1984

Location: 200,000 sq ft base in Shaftesbury, Dorset.

Founders: Geoff, 71 and Gin, 69 Hayward, dairy farmers, borrowed £30,000 from the bank to buy cheese and wine in bulk.

Staff: 65, although that number triples in the run-up to Christmas. Sam Hayward, the couple’s oldest child, who joined the business in 2001 after working as an auditor, will take over when his parents step down. One of his two sisters, Alix, 37, works on the marketing side.

Financials: Pre-tax profits were £1.4m last year on sales of £17.1m.

Investment: There are no plans to sell the business

News: more acquisitions are on the cards. The Haywards bought a home accessories business, Grand Illusions, in 2012 and a smaller hamper rival in 2013.

RUSSELL & BROMLEY: quaking in its boots as profits take a beating | Billy Bambrough, City A.M. December 19

DZ profile: Russell & Bromley Limited

Business: footwear purveyor. Prime Minister Theresa May is known to be a fan.

Location: Kent

Financials: Revenues for the company dropped 4.5 per cent in 2015 to £115m last year, while profits after tax fell to £16.6m, and the firm’s cash pile fell by more than £1m to £24.2m.

News:

- Plans to give its dividend a £3m haircut to £11m after profits and revenue took a hit. Last year Russell & Bromley raised its dividend by £1m to £14.3m.

- UK retail sales have continued to climb since the European Union membership referendum. In November sales volumes were 5.9 per cent higher than a year earlier.

HABITO: founder Daniel Hegarty talks fintech mortgages, bigamy and working above a kebab shop | Harriet Green, City A.M. December 19, 2016

DZ profile: Hey Habito Ltd

Business: fintech firm - digital mortgage broker. Lenders pay Habito, while mortgage applicants get told what the Habito is being paid when they make their application. 2 main strengths:

:: Habito analyses deals from 60 lenders in seconds. Most brokers will look at 11 to 12 lenders and process an application in two to three weeks. With nearly 100 lenders and 10,000 different products available in the UK, and prices often difficult to understand because of the focus on interest rates in rate tables, the startup needed to aggregate the entire market.

:: Offers a digital mortgage adviser: an AI chatbot that maps all current market regulations and a) provides information to a consumer in the form of pros and cons for each product, and b) guides them through, in 10 to 15 minutes, a full advice interview, offering real time agreements in principle with a provider.

Launched: 2015

Location: London E1

Founder: Daniel Hegarty, founder, was a professional musician, composing for TV and film and touring. In 2007, he joined a pre-launch company that was later named WONGA. As Wonga’s head of product, Hegarty spent his time building its technology, and developing the business’s products for an international market. Leaving Wonga at the end of 2013, he had an “absolutely horrifying experience” with a mortgage broker…buying a house.

Investment: Most of its investors are fintech founders themselves: Samir Desai of Funding Circle and Paul Forster of indeed.com came in for the seed round. Transferwise founder Taavet Hinrikus, Funding Circle's Samir Desai and Russian Billionaire Yuri Milner who also boasts investments in the UK's Citymapper, China's Xiaomi and the startup space of ex-government tech advisor Rohan Silva, SECOND HOME, are among early stage backers .

UPDATE:

Startup taking the hassle out of mortgages, Habito, has landed millions in new funding | Lynsey Barber, City A.M. January 23, 2017

1. In nine months ...has already helped 20,000 customers with £50m worth of mortgages and revealed it is growing at a rate of 30 per cent a month.

2.….has landed a further £5.5m of cash led by Silicon Valley's RIBBIT CAPITAL. Existing investor MOSAIC VENTURES also participated in the series A round bringing the total cash behind the startup to £8.2m. The investment will go towards growing the 25 strong team "fairly significantly" and largely in engineering, to help role out new product features. That includes a switching service similar to those which already exist for utilities or mobile contracts, alerting homeowners when it 's time to switch to a better mortgage deal automatically, Hegarty said, as well as approving mortgages in real-time. Much of this will come from development of its machine learning capabilities.

Proptech startup Habito lands £18.5m to make mortgages digital | Lynsey Barber City A.M.3 September 2017

's growth has been "explosive", its founder Daniel Hegarty said (Source: Getty)

3. ... millions more in funding. ATOMICO led the £18.5m series B round with existing investors RIBBIT CAPITAL, MOSAIC VENTURES and REVOLUTIONARY (AD)VENTURES also participating. ...brings total funding to £27.5m. Habito will use the fresh cash to build on its innovative chatbot mortgage broker with home and life insurance and is working with high street banks to add its real-time mortgage approvals technology to services, the company revealed. It will also grow staff numbers which have already tripled since April 2016.

4. It has already advised 50,000 customers complete more than £250m worth of mortgages.

GROOVEME: 3D hologram pioneer eyes London flotation | Michael Bow, Evening Standard. December 21

DZ profile:The Groove Musical Experience Limited

Business: One of the UK’s top special effects companies. Makes 3D holograms and worked on the new Star Wars film Rogue One. GrooveMe’s technology is mainly used to recreate rock stars performing their hits in 3D hologram form, which can then be beamed live to customers on demand.

Launched: 2013

Location: Alton, Hampshire

Founder: Alex Worrall FCCA, Chairman. Bio: “Massive music fan and serial entrepreneur having launched 3 companies on the London Stock Market, Alex is also a former Chairman of Thyssen Krupp and is currently Chairman of Black Hangar Studios in Hampshire (which have been used to film Salmon Fishing in the Yemen, Top Gear and 24 amongst others). Alex has been a senior industrial director or chairman for over 30 years which include him overseeing his own company’s growth from £1m to £160m.”

Financials: is forecast to turn its first profit this year

Investment: investors include Bob Geldof and Sarah Willingham from Dragon’s Den

News:

- GrooveMe, is exploring plans to float on the London stock market next year. A flotation could value it at around £25 million.

- Several stars have been hologrammed so far, including Boomtown Rats frontman Sir Bob Geldof, an investor in the Basingstoke firm. The recordings, which also include rockers Steve Harley & Cockney Rebel, are shot at Abbey Road studios, made famous by The Beatles. In future it is hoped they could be sold to Asia’s giant karaoke bar market, which boasts around 140,000 karaoke clubs in Japan alone.

- The company is also set to open a live site in Knebworth, home to Oasis’s record-breaking 1996 gig, next year to showcase the holograms.

COOK: helped to record by ‘Stress free’ Christmas | Michael Bow, Evening Standard. December 23

DZ profile: COOK Trading Ltd

Business: Upmarket frozen-meals maker ...stocks such items as veg, kale and lentil pies

Launched: 2002

Location: Sittingbourne, Kent

Founders: chief executive Edward Perry and Dale Penfold

Staff: 517. About 55% of employees are full-time. More than three-quarters of the 517 people on the payroll earn between £15,000 and £25,000 a year.

Financials: Sales rose 14% to £45m, with online sales up 50% to £4.4m. Pre-tax profits leapt 17% to £2.7m.

News:

1. Cook served up record profits last year thanks to the success of a new Thai range and “stress-free” Christmas lunches.The group bounced back from a slow start to the year to increase annual sales and profits by double digits, underscored by a “fantastic” Christmas period which boosted like-for-like festive sales by 9.1%. Thai curries and lower calories options drove sales in the rest of the year, which ended in March.

2. February 2016 was ranked 28th and the highest placed manufacturer in the Sunday Times Top 100 Companies to Work for.

UPDATE:

Retailer Cook serves up sales growth | Joanna Bourke, The Evening Standard. December 20, 2017

3. 17% surge in sales of meat-free goods over the past 12 months. Its £12 takeaway for two offers have also proved popular, with Brits flocking to buy Indian and Thai food, Perry added, helping to offset headwinds such as rising butter prices. The manufacturer has 85 stores including in Muswell Hill and Southgate. It has plans for a further six stores.

4. turnover jumped to £50.6m in the year to March 2017, from £45m the year before. Pre-tax profits fell to £2.7m.

PREMIER DECORATIONS: Rather than trifle with 30p tinsel we lit up the decoration industry | Laura Onita, The Sunday Times. December 25

DZ profile:Premier Decorations Limited

Business: sells home and outdoor decorations, as well as Halloween paraphernalia, to about 5,000 garden centres, supermarkets and wholesalers. Imports baubles, artificial wreaths and trees from China, India and Bangladesh. Claims to be Britain’s largest purveyor of Christmas ornaments. Most customers place their orders in January, so staff are packing festive trinkets all year round. Premier now sells about 13m individual items every year. Athwal’s biggest market is Britain but there are plans to sell to the Continent.

Launched: 1988

Location: Ruislip, west London. The company has a showroom in Wrexham, north Wales, the size of “five football pitches”, according to Athwal, as well as an office in Hong Kong.

Founder: John Athwal, 63

Staff: 82 people — rising to 200 at Christmas. His daughter, Jasmin, 39, and son, Jason, 36, are both directors of the company.

Financials: Last year pre-tax profits climbed to £4m on sales of £37.2m.

Investment: He owns 60% of the business, having sold a stake in the early days to raise cash. “They gave me £24,000,” he laughed. The company paid £3.1m in dividends on equity capital last year. Despite recurring offers from outside investors, Athwal does not want to part with more shares.