Published by Directorzone Markets Ltd on March 1, 2016, 9:00 am in Knowledge, Market Info

Wednesday January 1st 2020

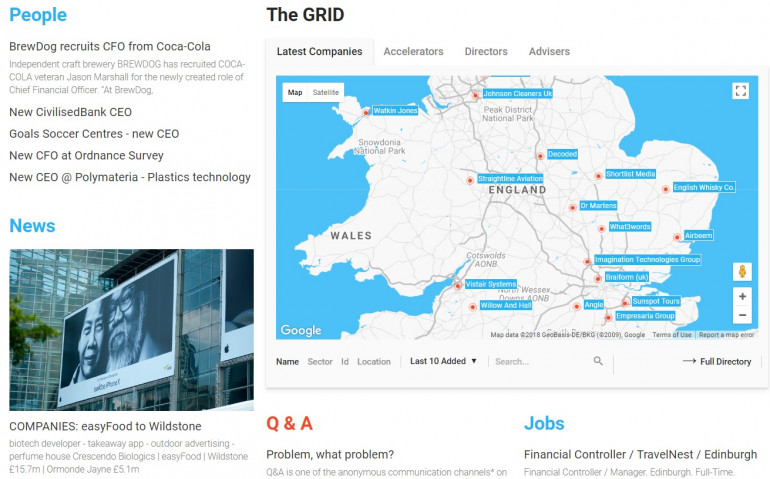

Digest of news and trends in the GRID marketplace in February 2016.

Gazelles outside London | Banks fund P2P | Sharing economy Trustmark | UK spin-out blues | Preparing for the industrial internet | Crowdfunding credibility

GAZELLES OUTSIDE LONDON

Regeneration of cities expands ranks of fast-growing businesses | Andrew Bounds, FT. 20 February.

“High-growth companies” — businesses with 10 employees or more that have increased their workforce by at least 20 per cent a year for three years. These high-growth, or “gazelle”, companies are usually found in sectors such as technology, professional services or advanced manufacturing. They generate a disproportionately large amount of jobs and are a big factor in the rise in private sector employment since the recession.

The ENTERPRISE RESEARCH CENTRE (ERC) - a group of universities that research small and medium sized businesses - says there are now nearly 12,000 of them in total in the UK — the highest level since the dotcom boom. Their numbers are growing twice as fast outside London, though the capital still has the highest proportion of any city.

According to the ERC, high-growth companies created about a third of private sector jobs between 2012-15 and accounted for 7.5 per cent of all companies with more than 10 workers. In London, the figure was 9.5 per cent.

….new research shows they are being created at a faster rate in cities such as Leeds and Southampton than in London.

Excluding London, numbers of high-growth companies in England rose by 36 per cent from 2009-12 to 2012-15. In LONDON, the increase was 15 per cent. In SCOTLAND, the growth was 35 per cent, while WALES went up by 38 per cent.

LIVERPOOL, one of the UK’s poorest areas, has a smaller business base than many cities but the number of high growth companies there doubled between 2009 and 2015, to 220. It now has the second-highest rate in England, as a proportion of total businesses with 10 or more employees. Liverpool is home to the largest cluster of biological manufacturing facilities in Europe, making everything from flu vaccines to TB treatments.

Richard Flint, chief executive of SKYBET, an online betting and gaming company based in Leeds, said shortages of qualified staff were the biggest challenge because many graduates gravitated to London. The business, which is private equity owned and growing 30 per cent a year, has 250 vacancies.

BANKS FUND P2P

P2P sheds ‘alternative’ label and moves into mainstream | Emma Dunkley, FT. 20 February.

ZOPA, the world’s first peer-to-peer lending platform, launched in the UK in 2005 …provided the blueprint for an industry that has burgeoned globally, giving credibility to alternative finance. … P2P is almost no longer an “alternative” form of finance but another lending channel for banks, hedge funds, pension funds and others. P2P — based on nimble online sites directly connecting lenders to borrowers — offers lenders a higher return than many investments, with interest rates in the region of 6 per cent.

About 25 per cent of the amount lent through P2P is made by institutions, including banks and hedge funds, according to a new report by the University of Cambridge and Nesta, an innovation charity. Banks are partnering with P2P platforms, with some planning to acquire sites or develop their own versions. Royal Bank of Scotland and Santander UK have struck deals to refer businesses they are not able to finance on to certain P2P sites, such as Funding Circle. Other banks, such as Metro, are lending customer deposits through a platform.

… the paradox is that, in order to grow, achieve scale and win the support of the crowd, P2P needs institutional money. Indeed, the term peer-to-peer “is a misnomer”, according to a report by Morgan Stanley. The report said … institutional funding, including banks …is “turbocharging” lending.

In some respects, the UK model is becoming similar to the concept behind securitisation, a financial structure employed by banks. Warren Mead, KPMG: “These platforms are building up books of business and then laying them off — in the same way banks built up a book of loans and then securitised them.”

….risks are emerging that threaten to puncture the sector, particularly the non-institutional side. Most of the UK’s platforms — of which there are more than 100 — have not been tested by rising interest rates, which could put pressure on borrowers and lead to defaults.

The industry has been scrutinised for some of its advertising …P2P lending is not a savings account and investors — whether amateur or professional — are not cushioned by the Financial Services Compensation Scheme if they lose their money.

Fraud is another emerging issue. …Adair Turner, the former chairman of the UK’s financial watchdog, said P2P platforms could be the source of “big losses” over the next five to 10 years that would “make even the worst bankers look like absolute geniuses”.

SHARING ECONOMY TRUSTMARK

Would you like to tuck into my leftovers? The sharing economy | Kiki Loizou, Sunday Times. 14 February 2016

Last year, Sharing Economy UK and Oxford University teamed up to create a “trustmark” for businesses in the booming sector. The first set of companies is due to start being assessed shortly.

UK SPIN-OUT BLUES

University spin-outs demand a better deal | Kiki Loizou and Peter Evans, Sunday Times. 14 February 2016

Lita Nelsen, working in technology transfer at the Massachusetts Institute of Technology (MIT), thinks… the terms forced on spin-out ventures mean Britain is losing out on ground-breaking innovation and world-beating companies.

Statistics revealed at the conference seemed to underline the gulf. Just 4% of global funds available to biotechnology firms are won by British companies. American companies attract 72%.

Nicholas Edwards, an Oxford alumnus who chairs investor network MEDINNOVATE, submitted recommendations to Oxford’s innovation group last year. He believes Isis Innovation needs an overhaul. “Oxford is probably the biggest centre for biomedical research in Europe. There is a lot of great science that is going on that’s either not being turned into commercial opportunities or it’s being turned into something in another country,” said Edwards. “It means the science doesn’t get translated into medicines and treatments . . . many of those patents are just sitting on the shelf.”

Kevin Johnson, partner at MEDICXI VENTURES, a venture capital firm that focuses on life sciences, said he often turned down opportunities because negotiations with universities were too much of a struggle.

Universities receive more than £1.5bn for research from the Higher Education Funding Council. Oxford was handed £140m and Cambridge £120m.

Neither Circassia nor Immunocore - 2 recent spin-out successes - has passed the ultimate test: getting its own drug to market and bringing in sales.

- CIRCASSIA, which is developing a treatment for cat allergies, listed two years ago, raising £200m in the biggest biotech float in London for decades. Circassia (market value £725m, down from £1bn last year) was spun out from Imperial College through Imperial Innovations.

- IMMUNOCORE. The drug developer, which specialises in immunotherapy — using the body’s defences to fight cancer — originated at Oxford. Last year, Immunocore raised £205m, the largest-ever private fundraising by a European biotech company. It is known to be considering a float, either in New York or London, in the next two years. Industry analysts believe it could be valued at more than $10bn (£6.9bn).

IMPERIAL INNOVATIONS, IP’s equivalent at Imperial College, often insists on placing a member of its top team on the board of a newly formed business. Woodford owns 13.4% of Imperial Innovations.

PREPARING FOR THE INDUSTRIAL INTERNET

Poor broadband threatens UK growth | Peggy Hollinger, FT. 9 February.

The UK’s broadband network is not sufficient to support the growth of industry, threatening the government’s ambitions to encourage fleets of “smart” factories that will drive productivity and competitiveness.

Roughly two-thirds of 128 companies responding to a questionnaire between December 1 and 31 by the EEF, the manufacturers lobby group, have said connectivity is not adequate to meet their needs for future growth. Worse, some 50 per cent says costs of accessing internet services have risen over the past two years.

Internet access is now as important as electricity or water to the UK’s industrial companies. The digitisation of every aspect of production, from ordering raw materials to making and delivering products, promises to revolutionise manufacturing and help the UK to compete against countries with cheaper labour.

However, this so-called fourth industrial revolution will require vast amounts of data to be collected and processed via the internet.

The EEF is calling on the government to launch a review of competition for business broadband, with a particular focus on leased lines. It should promise to bring down costs by the end of this parliament, the EEF has said. The goal is to prepare UK infrastructure for the arrival of the industrial internet. Almost two-thirds of businesses surveyed said they expected to invest in internet connected capital equipment in the next five years.

CROWDFUNDING CREDIBILITY

Crowdfunding sites and finance houses merge | Andrew Bounds, FT. 11 February

Government innovation charity Nesta estimates that there are about 30 equity crowdfunding sites in the UK. But recent research by AltFi Data and law firm Nabarro showed that one in five companies that raised money on equity crowdfunding platforms between 2011 and 2013 had gone bankrupt.

Jean Miller, chief executive of InvestingZone, said …“We want to attract technology businesses. We don’t want punters putting £10 into a brewery because they understand it or want a few crates of beer every year. We want credibility.” She added that professional investors were put off by unrealistic valuations and the “Kickstarter” model that treated investments almost as philanthropy.