Published by Directorzone Markets Ltd on October 3, 2016, 9:00 am in News, Other

Thursday February 14th 2019

EndsThursday February 14th 2019

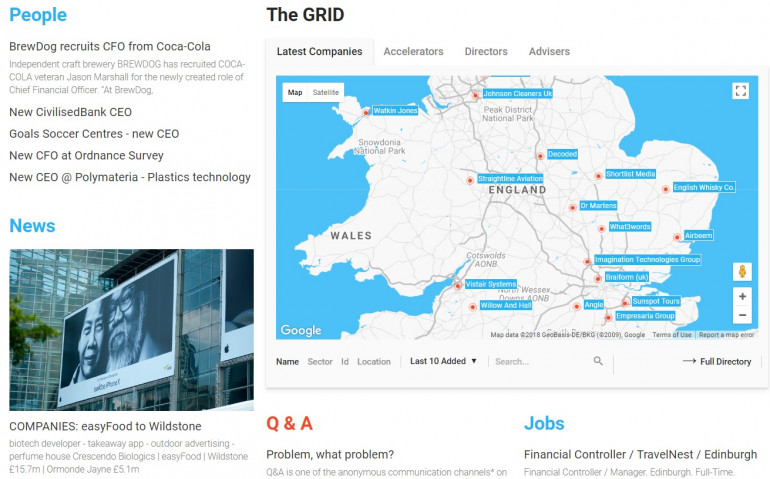

News about 7 UK growth companies and/or accelerators + turnover in the GRID marketplace, 25th September – 1st October2016:

DueCourse | Performance Horizon | The Floow £4m | Yorkshire Wildlife Park £10.3m | Syft | Supercarers | Hannam & Partners £7.4m

Cash-hungry start-ups need more than one capital city | Kiki Loizou, The Sunday Times. September 25, 2016.

DUECOURSE

DZ profile:

Business: invoice financing firm

ICB Classification:

Launched: 2015

Location: Manchester

Founders: Paul Haydock, 32, Jon Grove and Tim Borden

Staff: is expanding its team of 12

Investment: Raised £175,000 from an angel investor in the early days in London. Has won more than £6m of investment from backers in London, including Zoopla founder Alex Chesterman and Lovefilm co-founder Simon Franks. Hopes to raise a further £15m next year to expand internationally.

PERFORMANCE HORIZON

DZ profile:

Business: develops marketing technology for large corporations

ICB Classification:

Launched: 2010

Location: Newcastle. Has offices in America, Japan and Australia

Founder: Chris Blaxall, 59

Staff: 150 and plans to add another 50 workers to its books by the end of the year.

Investment: he has looked mainly to America for investment. Last year the company raised more than £10m from New York’s Greycroft Partners, and more than £5m from PayPal founder Peter Thiel’s Mithril Capital.

THE FLOOW

DZ profile:

Business: telematics / black-box technology which assesses drivers and traffic. Collects data for motor insurers from a driver’s phone or a black box in their vehicle. The data helps to establish how much an insurance claim or policy should cost. Clients include Direct Line and AIG

ICB Classification:

Launched: 2012

Location: Sheffield

Founder: Aldo Monteforte, chief executive

Staff: 70

Financials: saw revenues jump 60% last year to £4m

UPDATE:

Whatever Brexit brings, we’ll always have Lisbon, says Streetbees boss | Peter Evans, The Sunday Times. May 20 2018.

1. Staff: 120. The Floow received £13m investment last year in a round led by China’s Fosun.

YORKSHIRE WILDLIFE PARK: Saving a starving pride of Romanian lions put Yorkshire park on the map | Laura Onita, The Sunday Times

DZ profile:

Business: walk-through wildlife attraction. There are nearly 400 animals large and small, including polar bears, leopards, camels, baboons and meerkats. Zoos in Britain, Ireland and continental Europe provide the animals. Entrance to the attraction costs up to £16.50 and visitor numbers neared 700,000 last year.

ICB Classification:

Location: Branton, near Doncaster

Founders: Cheryl Williams, 54, with her husband Neville, 60, and friend John Minion. Williams has a 22% stake in the business with Neville, he operations director. Minion’s father is the majority shareholder.

Staff: 100

Financials: reported pre-tax profits of £3.4m on sales of £10.3m last year.

Investment: The founders had bought the 260-acre site, previously a farm, with £600,000 raised from friends and family, a bank loan and a grant.

News:

1. In 2009 the co-founders started a campaign to save a malnourished pride of 13lions about to be put down at a dilapidated zoo in Romania. In five months they raised the £150,000 needed to fly them to Britain in a specially converted Boeing 737. Today the lions roam freely in their own nine-acre reserve.

2. The rescue mission brought valuable publicity. “We went from 66,000 visitors in our first year to 200,000 the next.”

3. The bosses aim to reinvest profits and hope to boost visitor numbers by organising more events. In 2013 they opened a £1.2m wedding and conference venue.

SYFT: The founders explain how they're saving clients 55 per cent – and why there's an upper limit to Lionel Ritchie | Harriet Green, City A.M. September 26

DZ profile: Syft Online Limited

Business: recruitment app and online solution to hospitality work with over 1,200 job seekers signed up across the capital, and numerous restaurants and events companies using them. Syft saves its clients 55 per cent in fees that would otherwise go to an agency. If they list a job and put it out to Syft’s vetted and trained workers – it’ll frequently be filled within minutes. A new capability allows employers to create a pool of favourite workers, who are given first refusal on work. The app will give workers a shift time, job description, address, who to report to and uniform if required. Client restaurants include Coya, Mahiki, Steam and Rye, and Madison. Syft workers get, on average, £9.30 an hour. Syft also enables both sides to rate each other, upping incentives.

Launched: 2015

Location: London

Founders: Jack Beaman and Novo Abakare

Staff: 16

Investment: just closed their seed investment round – led by PROFOUNDERS CAPITAL, it was meant to raise £1.2m, but the pair ended up with £2.65m.

News:

1. “Our fee is so much smaller than a traditional agency, which is usually £13 to the employer, £7 to the worker. We just add 15 per cent on top of whatever the employer wants to pay,” says Abakare. “The great thing about our model is that we make back the cost of acquiring new users very early.”

2. With new hires from LinkedIn and YPlan, new offices became too small within a week, which resulted in the hole being knocked through to the fortuitously empty neighbouring office.

3. Expansion. Plan to add a new UK city - Manchester, Birmingham or Cardiff. The next investment round will look at expanding overseas - LA, New York, Paris.” The founders are also interested in expanding into different sectors, doing more permanent placing (they do a little bit now), in addition to another revenue stream around hospitality.

UPDATE:

Temp app Syft in £6 million funding boost | Jamie Nimmo, The Evening Standard. 7 September 2017

Boxing clever: David Haye, a Syft investor, with founders Novo Abakare and Jack Beaman Nils Jorgensen

4. ...backed by former boxing champion David Haye, has received an extra £6.1 million in funding. The Series A round was led by CREANDUM, the Stockholm-based venture capital firm best known for backing music-streaming giant Spotify. It follows a £2.65 million cash injection for Syft a year ago, which Haye took part in. He did not invest in the latest round.

5. Syft claims to save its clients 55% in temp fees. It has been focused on hospitality but wants to expand into warehouse and industrial jobs.

SUPERCARERS: Meet the Pikes: The brothers who gave up corporate jobs and first-home deposits to launch SuperCarers | Harriet Green, City A.M. September 26

DZ profile: Super Carers Ltd (SuperCarers)

Business: online solution to placing carers for the elderly in the home. The app enables relatives to use a two-step matching process to find a carer. They’ve designed the app so family members can see when a carer has arrived, with a new feature being built that’ll give further updates while the carer is working. The Pikes vet, verify and interview all the carers on their books, and a review based system helps people pick

Launched: 2014

Location: London

Founders: Adam - former management consultant at Deloitte - and Daniel - former PwC accountant - Pike, fter they watched their grandmother struggle with early-stage dementia in a care home.

Investment: Backed by Innocent drinks via its JAMJAR FUND, it also counts former Marie Curie chief executive Sir Tom Hughes-Hallett as a backer, with the Care Quality Commission’s Alan Rosenbach as its chair. Before going for investment in September of last year, the brothers used money for deposits on first homes to bootstrap their business.

News:

1. On the carer side, the brothers are proud that they can pay £12.80 an hour – a far cry from the £3.27 that’ll see Haringey Council taken to an employment tribunal. “Another fundamental question for us is ‘how can you make pay transformative for carers?’ They’re currently getting a raw deal. We pay carers less than our cleaners. What does that say about our society? Each of us should ask ourselves whether we’re really caring enough,” says Adam.

2. Currently, SuperCarers only operates in London, but the ambition is “to be the Number One provider of home care in the UK,” says Daniel. “That’s children with disabilities, respite work, other professions to help elderly patients like physios and nurses. Most importantly, our vision is to put SuperCarers at the heart of the health ecosystem: if you’re an NHS trust and you have an issue with delayed transfers of care. If you’re a local authority and you have a major issue with provision. If you’re a private insurer and you’re wanting to minimise the re-admission to hospital after an operation, you can go into our site, build a care team around that patient or client and ensure they’re serviced by an outstanding team of professionals.”

3. Even now, the idea isn’t just to add B2B capabilities, but to build an enterprise solution, too. “We’re starting to have conversations with companies that’d like to offer schemes to employees. Employers lose a lot of days to caring. People say they’re ill and they’re actually with their parent.”

UPDATE:

How tech shows its caring side | Peter Evans, The Sunday Times. December 9 2018

4. Backers include MOBEUS EQUITY PARTNERS, SENECA PARTNERS and JAMJAR, the fund run by Richard Reed and his fellow Innocent Drinks co-founders.

5. Alzheimer’s disease accounted for more than one in eight deaths last year. SuperCarers offers professionals with specialist experience, giving families peace of mind while also potentially helping to improve patients’ condition. “You can influence dementia through customer care,” said Adam Pike, 33.

Despite decades of trying and billions spent, the pharmaceuticals industry has yet to develop an effective dementia treatment. There are no approved medicines that significantly delay the onset of Alzheimer’s, let alone cure it. The last drug approved for use, in 2003, alleviates only some symptoms.

HANNAM & PARTNERS: 'King of mining’ Ian Hannam digs up profits despite industry gloom | Jamie Nimmo, Evening Standard. September 27

DZ profile:

Business: corporate finance boutique with focus on natural resources deals. The firm’s biggest public deals included advising on the £135 million takeover of Asia Resource Minerals, the Indonesian miner formerly known as Bumi, and Worldview’s equally divisive buyout of Irish oil explorer Petroceltic. Much of its business is raising capital for private clients.

ICB Classification:

Launched: 2012

Founder: Ian Hannam, the former JPMorgan rainmaker and so-called “King of Mining”, who was fined for market abuse

Staff: Partners include Hannam and veteran City broker Tim Hoare.

Financials: Turnover rose 37% to £7.4 million and pre-tax profits rose from £570,000 to £2.4 million in the 12 months ended March

News:

1. Hannam, a former Territorial Army captain who earned a reputation for arranging huge mining deals including Glencore’s tie-up with Xstrata, was fined £450,000 by the Financial Services Authority in 2012 for giving insider information on Heritage Oil to Kurdistan’s oil minister.

2. He resigned from JPMorgan in 2012 and bought Strand Partners the same year before rebranding it Hannam & Partners.