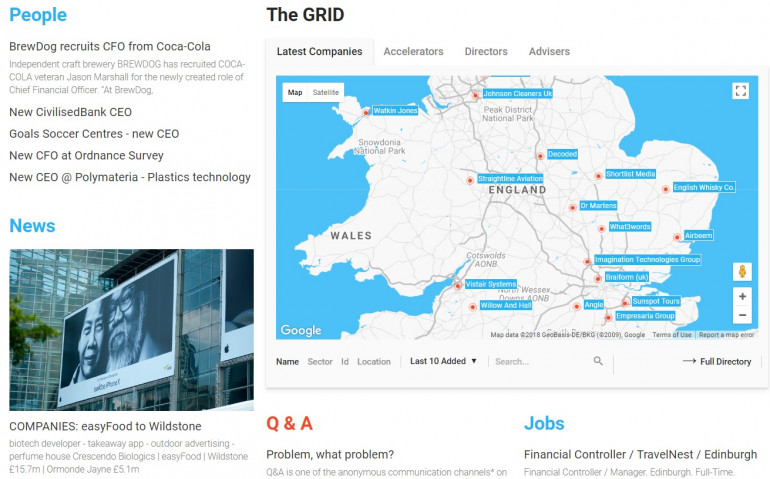

Published by Directorzone Markets Ltd on December 21, 2015, 9:00 am in News, Other

News about 14 UK growth companies and/or accelerators in the GRID marketplace, 13 - 19th December 2015:

Vistair | Tamdown Group | The Entertainer £129m | Edmar Engineering | Lambert Engineering £20m | Walker Greenbank £83.4m | Coinsilium | Lapland UK £4m | Audioboom £50k 1/2 year | Imagination Technologies £71.1m | Makerversity | Unmade | Mayku | Nipper

VISTAIR: Flight manual pioneer takes off / Sunday Times. 13th December.

DZ profile: Vistair Systems Limited

Business: turns pilots’ paper flight manuals into iPad documents for customers including British Airways, Emirates and easyJet.

Launched: 2001

Location: Bristol

Founders: Ian Herbert, former BBC engineer, and serial entrepreneur and software expert David Hedley. Both remain significant shareholders and will continue to run the company.

Investment: has been sold in a deal valuing it at more than £15m. Sold a majority stake to private equity house SYNOVA CAPITAL to raise £9m.

News: July 2015 received the Queen’s Award for Enterprise in recognition of its outstanding performance trading overseas.

TAMDOWN GROUP: Essex builder eyes float fortune / Oliver Shah, Sunday Times.

DZ profile: Tamdown Group Limited

Business: construction services group which specialises in building concrete frames for high-rise developments, restoring contaminated land and laying groundworks. It also has a utilities subsidiary, TriConnex, which helps housebuilders to make sure their plots are linked to electricity, gas and water networks on time. Its housebuilding customers include St George, part of Tony Pidgley’s Berkeley Group, Taylor Wimpey and Persimmon.

Launched: 1976

Location: Braintree, Essex.

Investment: Parent company Garbol. Mike Morris chairman, 48, and his family own about half of Tamdown, which could be valued at £100m or more. Morris has led the business since 1999. Keith Breen, managing director, who owns about a third of shares. The rest of the shares are owned by other managers.

News: hired the broker Numis to explore a float of Tamdown Group.

THE ENTERTAINER: How I Made It: Gary Grant, co-founder / Laura Onita, Sunday Times.

DZ profile: The Entertainer (Amersham) Limited

Business: Britain’s largest independent toy store chain - 116 stores. Today, 20% of sales are made through the Entertainer’s website.

Launched: 1981

Location: Amersham, Buckinghamshire

Founders: Gary Grant, 57, and wife Catherine, 61, are majority shareholders. They have shared some of the equity with their four children. In 1981 paid £19,000 for the Pram and Toy Bar, which had annual sales of £35,000 and sold old-fashioned stock. “We painted the walls red and spent money on a more varied range. In our first year we did £100,000 and a year later £250,000,” he said. Four years later, he opened a second shop in nearby Beaconsfield.

Financials: made profits of £6m on sales of £129m in 2014. Expects sales of £170m this year.

News:

1. Give 10% of profits to charity. “We apply the Christian faith in the way we run the business, whether it’s Sunday trading or the types of products we stock,” Grant said.

2. There are plans to expand the business overseas through a franchise model. Grant already has four franchises in Pakistan and Azerbaijan.

Osborne cuts supplies to march of little makers. Axing the Business Growth Service in the spending review angered entrepreneurs / Kiki Loizou, Sunday Times.

EDMAR ENGINEERING

DZ profile: Edmar Engineering Co. Limited

Business: Family manufacturing business. Makes small parts and prototypes for customers such as Cadbury.

Launched: Hayton’s great-grandfather started the Aston-based business 70 years ago.

Staff: Sue Taylor, managing director; daughters: Anna Hayton, 41, director and sister Jayne Sheppard.

Location: Birmingham

Staff: 15 people

News: The cuts are a blow to Edmar Engineering, which has received more than £40,000 of grants over eight years from MAS and helped it to build relationships with industry experts. Management training came as part of the package.

LAMBERT ENGINEERING

DZ profile: Lambert Engineering Limited

Business: engineering

Launched: 1973

Location: Tadcaster, North Yorkshire.

Team: Warren Limbert, 43, managing director

Staff: 185

Financials: sales of about £20m a year.

News: Scrapping MAS, in particular, will do much more harm than anticipated by ministers, said Limbert. The company has received about £60,000 of grants as well as years of support from experts through MAS.

WALKER GREENBANK: profits hit by Storm Desmond / John Murray Brown, FT.

DZ profile: Walker Greenbank Plc

Business: Aim-quoted upmarket wallpaper company. In addition to its fabric prints business, it manufactures high-end wall coverings with complex designs and textured paper. Owns the Sanderson, Morris & Co, Zoffany and Harlequin brands.

Location: Buckinghamshire. Factories in Loughborough, Leicestershire and Lancaster. Showrooms in London, New York, Paris, Amsterdam and Dubai along with partnerships in Moscow and in Shenzhen, China.

Staff: more than 600

Financials: Full-year pre-tax profits of £8.1m for the year to January 31 2015, up 11 per cent. Group sales £83.4m: two-thirds UK and 15 per cent of products sold in the US.

News: Flooding caused by last week’s Storm Desmond in the UK has caused substantial damage at Lancaster factory, meaning full-year profits at the upmarket wallpaper company will be 15 per cent lower than forecasts. The building, specialises in printing designs on to fabric for luxury brands such as Burberry, Barbour and Ted Baker. The company expects the majority of printing capacity back on stream by the end of April 2016.

COINSILIUM: becomes first blockchain company to float / Peter Campbell, FT.

DZ profile: Coinsilium Limited

Business: invests in companies that develop uses for shared database technology, known as a “distributed ledger” system. Its investments include a company that can process payments of a fraction of a penny, and one that allows older mobile phones to be used for mobile payments.

Innovation: Distributed ledger technology — the so-called blockchain — is where transactions are broadcast to a host of computers simultaneously, rather than being processed in a central place. The technology underpins the bitcoin digital currency. Analysts say the potential uses are far wider because the system allows instant payments that bypass traditional banking systems. However, few firms have found a way to make money from the technology.

Launched: 2013

Staff: Cameron Parry, executive chairman

Financials: started to generate revenues in recent months “in the tens or hundreds of thousands” — mainly from advising other firms on the blockchain. Expects to be profitable by the end of next year.

Investment: raised £3.3m in the private markets over the past two years

News: will float on ICAP’s high-growth ISDX market next week, for what it says is the first ever initial public offering of a blockchain technology group, after raising £1m. It will open on Seedrs, the crowdfunding platform, to allow members of the public to buy into its listing.

LAPLAND UK: plans to be the Cirque du Soleil of Christmas shows / Michael Bow, Evening Standard. 14 December.

DZ profile: LUK Events Limited

Business: an immersive theatrical experience hosted every year on the Windsor Estate near Ascot, Berkshire, which has become Britain’s biggest outdoor winter wonderland-style Christmas show. Visitors trekking down to the forest are treated to a three-and-a-half-hour show taking in toy making, ice-skating and West End-style theatrics, ending with a personal audience with Father Christmas. The couple convinced the Forestry Commission to let them stage the show on land in Kent in the first year, sold 37,000 tickets and three years ago was invited by the Crown Estate to move to the Windsor Estate. “We think of it as one big stage. It’s a bit like Glastonbury or the Chelsea Flower Show. The budget runs into the millions.” Celebrity fans include Sir Paul McCartney, Cheryl Fernandez-Versini and Sir Elton John.

Launched: 2007

Location: Windsor

Founders: Alison Battle, a former primary school teacher, and husband Mike, former City trader

Staff: up to 400 staff

Financials: Turnover £4m

News: About 50,000 tickets have been sold this year, a record haul, and the company has plans to open a second site in Cheshire.

AUDIOBOOM: shares slide after warning on slow revenue growth / Peter Campbell, FT.

DZ profile: Audioboom Limited

Business: podcast platform firm and streaming company which allows users to share online sound clips from music and audiobooks by embedding them into their own websites

Financials: First half of the year sales £50k. Last year made an operating loss of £2.1m, with Arden analysts expecting this to deepen to £5.2m this year. The group said it still expected to become profitable in 2017.

Investment: Aim-listed company

Staff: Rob Proctor, chief executive

News:

1. Shares fell 24 per cent after AudioBoomwarned that revenues were “below market expectations” in a year when the number of times its clips were played almost doubled ...to 4.6m.

2. AudioBoom said the number of “listens” — each time an audio clip is played — “is the sole driver of advertising revenue”. ..this figure increased about 70 per cent to 300m, compared with 180m year earlier.

3. In July, AudioBoom agreed a deal with Cumulus, the second largest radio station owner in the US. ....which saw 450 regional US radio stations using its technology to broadcast online

UPDATE:

AudioBOOM: Revenues at podcast platform more than quadruple year-on-year | Jasper Jolly, City A.M. July 20, 2017

4. Revenues increased to £1.8m in the six months up to the end of May, up by 460 per cent from £329,000 in the first half of last year.. The firm said it has booked £4m for 2017, including first-half revenues.

5. ...content partner channels (i.e. City A.M.) now more than 11,000, up from 8,000 last year.

6. ...acquired natural language processing and AI development company SONR NEWS for £1.43m in February ... pointing to a future beyond podcasting in the growing world of voice-controlled technology. Rob Proctor: "...our overall strategy of content acquisition, content creation and media sales is being further validated by the rapid rise in voice activated, hands-free, screen-free, internet search requests via digital home assistants, such as Amazon Echo and Microsoft's Cortana."

Audioboom shares have tumbled after its finance chief suddenly departed | Emma Haslett, City A.M. July 27, 2017

7. ...has parted ways with its CFO, David McDonagh. It is understood McDonagh had frequently disagreed with chief executive Rob Proctor over the company's growth strategy. …chairman Malcolm Wall

Audioboom has cranked up the volume by partnering up with Deezer | Emma Haslett, City A.M. July 27, 2017

8. ...partnership deal with DEEZER giving the the French streaming platform's 12m users direct access to podcasts. ...podcasters who use the platform (including City A.M.) will now be able to distribute their content to Deezer listeners ...Deezer listeners will be given access to 230 podcasts in English and Spanish.

Nick Candy backed Audioboom launches £134 million takeover of US rival Triton Digital | Mark Shapland, The Evening Standard. 13 February 2018

9. ...has launched headfirst into an ambitious reverse takeover of US rival TRITON DIGITAL. The AIM-listed firm — worth just £35.2m and backed by property tycoon Nick Candy — said it planned to buy the share capital of Triton Digital’s parent company for £134m. Audioboom will take its partner’s name, while Triton’s Neal Schore will become chief executive and Mark Rosenbaum chief financial officer. Audioboom’s current chief executive Robert Proctor is to step aside and be executive director. The deal gives Audioboom access to the US market — reportedly worth $17.5 billion in annual advertising. Dubbed the “Netflix of radio”, Audioboom has Sue Perkins and the QI production team signed up.

Small-cap spotlight: Audioboom cuts losses | Mark Shapland, The Evening Standard. 21 January 2019

10. ...said it has cut losses after attracting talent such as Jonathan Ross and Heston Blumenthal. Revenue in the 13 months to the end of December was $11.7m, compared with $6.1m the year before. The loss was $5.2m against a loss of $5.7m a year earlier.

IMAGINATION TECHNOLOGIES: shares fall sharply on profit warning / Peter Campbell and Murad Ahmed, FT.

DZ profile: Imagination Technologies Group Plc

Business: chip designer which develops graphics processor technology for smartphones and tablet computers. Largest customer is APPLE, making it particularly vulnerable to slowing growth in the high-end phone segment. The group’s traditional strength has been in chips for graphics processing and gaming but it has also been investing heavily in new product lines, including communications chips and core processing technology that pits it against UK rival ARM HOLDINGS.

Staff: Sir Hossein Yassaie, chief executive.

Financials: pre-tax loss in the six months to October deepened to £22.6m, from £10.7m last year, while revenues slipped from £82.2m to £71.1m, as it ramped up spending on research and development. In September the group blamied slowing growth in China and other emerging markets. It also reported that a major customer had decided to “ramp down” an older version of a silicon chip earlier than had been expected. Licensing revenue fell from £16m to £12.6m, while royalties slipped from £56.2m to £49.8m.

News:

1. Shares fell sharply as the company blamed a slowdown in the semiconductor market for widening half-year losses and another profit warning. Has seen its shares lose 35 per cent of their value in the past three months.

2. The number of chips shipped containing its technology fell 10 per cent to 584m. Phonemakers and companies in their supply chain are suffering a squeeze from slowing growth in high-end handsets, while the explosion of demand for cheaper models from less developed economies is hitting margins across the sector.

3. Chip designers are also grappling with the rise of connected devices, known as the “internet of things”, where less expensive chips are required in greater numbers to link up ordinary household items.

4. On Tuesday the company announced it had won a “multiyear agreement with a tier-one mobile market partner” to provide it with technology.

UPDATE:

Imagination Technologies deal ends run as UK’s bright spark | Nic Fildes, FT, November 4, 2017

5. ...sale of Imagination Technologies, to the Chinese-backed fund CANYON BRIDGE. The fact that Benjamin Chow, the founder of the private equity purchaser, had been charged with insider trading in the US only hours before did nothing to disrupt proceedings.

6. The group put itself up for sale in June after Apple — by far its largest customer and a significant shareholder — abruptly revealed it would stop using the British company’s graphics processors for future products. ...the UK group initially came out fighting. It asserted that it would be “extremely challenging” for Apple — which had looked at buying the UK company the previous year — to develop its own graphics chips without infringing on its patents. Still, Imagination’s share price crashed 62 per cent on the day, wiping £400m off its equity value. Taking on Apple, a company with an annual legal bill several times the size of its market capitalisation looked an insurmountable challenge — and Imagination was soon formally put up for sale. There had been early warning signs of Apple’s raid. Imagination had started losing some of its key engineers to the US group as long ago as 2015. By October 2016, Apple raised the stakes when it poached John Metcalf, who had been Imagination’s chief operating officer for a decade. The US group also set up a new office in St Albans, seven miles away from the UK company’s headquarters, to focus on chip development. Dozens of key Imagination staff jumped ship. Janardan Menon, an analyst with LIBERUM, says the loss of Apple as a customer undermined Imagination’s recovery from a botched diversification into computer processing technology via the MIPS takeover — a move itself designed to reduce the company’s overreliance on Apple’s appetite for its chips.S

7. Imagination was founded as a tiny maker of PC technology called VideoLogic in 1985, before Sir Hossein Yassaie, an Iranian immigrant known for his powder blue shoes and dreams of creating a global technology powerhouse, joined the business in 1992 and set it on a different course. First it developed graphics technology used for Sega gaming consoles and then, under the Imagination name, transplanted those designs into the mobile phone market, still in its infancy. By the time Imagination founded Pure, the digital radio brand that pioneered the DAB market, it stood as a post-tech bubble success in the UK. Intel and Apple bought sizeable stakes to stop each other acquiring the business. Hossein was ousted in 2016 and a new team, led by ex-Alent chief executive Andrew Heath, set about cleaning up Imagination, refocusing the business and improving its profitability.

8. Five years ago Imagination opened a £20m headquarters in Kings Langley, a Hertfordshire town more famous for producing malt drink Ovaltine than its thriving technology industry. The company said it would soon employ 1,000 workers. Its chip designs were already in two-thirds of the world’s smartphones and it predicted that 1bn devices using its processors would be shipped by 2017. But 2012 proved to be the group’s apex, as a £28.5m profit before tax more than halved the next year before Imagination slipped to a series of losses. A £29.4m pre-tax loss in its 2016 financial year triggered Sir Hossein’s departure, as the business was accused of losing its focus and taking on too much with the acquisition of a company called MIPS.

9. One adviser ...says the share price collapse opened the door to Chinese buyers that were prepared to pounce. “The resource is available and they are prepared to act quickly. The fact Imagination has lost Apple — they don’t care. The Chinese domestic market is so big, they are effectively the buyer and the customer. It is self-fulfilling,” he says. Ray Bingham, a partner at Canyon Bridge, says Imagination is now out of limbo and his firm will invest in rebuilding its research and development team to target new fields including virtual reality and the internet of things sector. That could deliver on Sir Hossein’s original vision that UK designed chips could power “anything with a screen”. Canyon Bridge has made commitments to maintain Imagination’s presence in Hertfordshire and invest in its workforce.

Makers follow the techies to create a ‘nurture’ space of their own / Michael Pooler, FT.

MAKERVERSITY:

DZ profile: Makerversity Ltd

Business: affordable workspace and hub for designers, artists and engineers who are striving to turn their ideas into commercial ventures - making physical things on a small scale using the latest product design and technologies. 25,000 sq ft communal studio, social centre and business incubator.

Innovation: Workshops with bandsaws, belt sanders, 3D printers and laser cutters. “With digital manufacturing there are processes that once needed a full-on workshop or factory but which can now take place on somebody’s desk,” co-founder Tom Tobia says. “Something like 3D printing enables you to prototype ideas from decorative objects to moving parts and iterate and develop them very quickly.”

Founder: Tom Tobia

Location: Somerset House, a London arts and cultural institution.

News:

1. Makerversity has hosted projects ranging from digital textile production to biotechnology hardware. Of its 170 members, more than a third are now profitable businesses, which generate a combined revenue of more than £5m. Makerversity receives some sponsorship but says it is not reliant on handouts. Members pay a fee dependent on the stage of their development and workspace size. Mr Tobia says this helps fulfil its social objective of education and allows it to provide free services for under-25s as well as some discounted and free memberships.

2. Unmade co-founder, Ben Alun-Jones. “It is a big community of like-minded people from a design background. It’s also multidisciplinary, with people like set-builders and photographers we could collaborate with.”

3. Makerversity members Unmade, Mayku and Nipper. See below.

UNMADE

DZ profile: Unmade Ltd.

Business: plugs proprietary software into industrial knitting machines to produce one-off jumpers and scarves.

Innovation: “mass customisation” production processes that combine aspects of high-volume manufacturing with bespoke tailoring. At its pop-up shop in nearby Covent Garden, customers use tablets to order from a selection of styles that can be altered to their tastes. Behind a glass window, a large, automated machine can turn out items within two hours.

Launched: 2013

Founders: Ben Alun-Jones and 2 friends, with help from a government grant

Staff: more than 20 staff

Investment: raised £2m in funding this summer.

News: A concession at Selfridges, the department store, is planned for next year.

MAYKU

DZ profile: Mayku Limited

Business: has designed small, mobile versions of manufacturing tools, which it has made by a company in Wales. One is a vacuum former that turns flat pieces of material into a 3D shape, such as plastic moulds or phone cases. The other is a rotation moulder, which casts hollow forms like vases, lamp shades and Easter eggs.

News: Mayku says its products facilitate local manufacturing by giving customers a “desktop factory”.

NIPPER

DZ profile: Design On Impulse Limited

Business: "newly formed design studio based in London, focusing on bringing the latest tech and stylish design into new products.Our first product, the Nipper phone charger, was the winner of Direct Line's Everyday Fix Competition and from here we're developing new power solutions and wearable tech integration." Miniature emergency phone charger powered by an AA battery that clips on to a key ring.